Summary report: GB wholesale electricity market reform: impacts and opportunities for Scotland

Research completed: July 2024

Non-technical summary

This is a non-technical summary to a report published separately as GB wholesale electricity market reform: impacts and opportunities for Scotland. The reader is invited to refer to the full report for detail.

Context

This study assesses the impact that the introduction of locational marginal pricing (LMP) to the Great Britain (GB) wholesale electricity market would have for Scotland, as well as the impact of potential alternatives. LMP has been proposed as a potential reform in the UK Government’s Review of Electricity Market Arrangements (REMA) consultation, which aims to reform electricity markets to enable a net zero energy system. LMP would be a significant reform and is of particular interest to Scotland, as the country is likely to be affected differently to other parts of GB.

We conducted a literature review and assessment of LMP and its alternatives between September 2023 and January 2024. It is an independent review and is not the view of the Scottish Government. This included a detailed assessment of quantitative and qualitative literature, as well as input from an expert advisory panel. The panel was invited to attend two 2-hour discussions, commented on, and reviewed interim findings. It consisted of stakeholders across government, energy research centres, renewables developers, flexibility providers, industry and business representatives, energy suppliers, large consumers of electricity in Scotland, a community energy group, and a consumer protection and advocacy body. Its views have been considered and included in the development of this review. This is the non-technical summary, with a detailed report published separately.

Locational marginal pricing

The wholesale electricity market is where electricity is bought and sold before it is delivered to consumers. Its main participants are electricity generators and suppliers. The current wholesale market is national and marginal. This means that electricity can be bought and sold anywhere in GB at a single national price[1], regardless of the physical constraints, or bottlenecks, on the transmission network. An example of this can be found at the B6 boundary that separates the transmission network between Scotland and England. Constraints arising here limit power flow (typically southward). Generators and consumers are not directly incentivised by the wholesale market to place and operate physical assets that generate or consume electricity in a way that is efficient for their specific location on the electricity network.

Electricity is traded in advance based on a predicted amount of electricity demand. The amount of electricity generated in real-time is adjusted by the electricity system operator (National Grid ESO) to meet the actual, rather than the predicted demand. The cost incurred by National Grid ESO is then passed on to consumers through their electricity bills. When traded generation is expected to exceed the maximum power flow of the network (creating a constraint), additional trades need to be made by National Grid ESO in affected areas to change the expected operating schedules of generators or consumers. With network build not keeping up with the growth in renewables, this inefficiency is accelerating and contributing to higher electricity bills for consumers (National Grid ESO, 2022a).

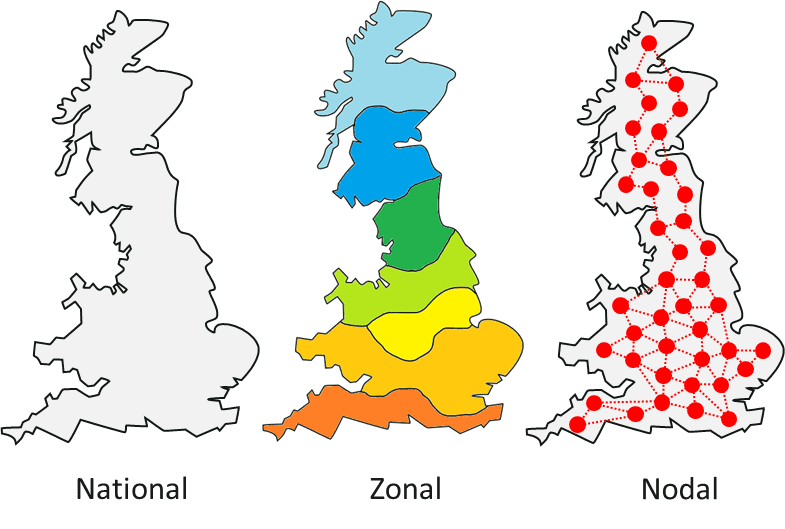

LMP could help reduce this inefficiency by splitting the national market into smaller geographic areas called zones or nodes (see Figure 1). This creates smaller markets that reflect the supply and demand in an area, and the constraints of the network. Areas where the supply is higher than demand will see prices fall, and areas with higher demand will see prices rise. This could incentivise generation and demand to locate where they do not exacerbate constraints. However, it is necessary to consider the wider, non-price factors that also influence decisions by generators and consumers on where to locate. These include the availability and quality of renewable resources (e.g. wind speed or seabed space), supply chains, skills, planning and consenting.

Additionally, the daily variation in price within these locational markets would reflect the instantaneous state of the local network. The result of this would be to create better signals that indicate how to operate flexible assets such as battery storage, international interconnectors, demand side response and dispatchable low-carbon generation (such as hydrogen or biomass) more efficiently. This helps to balance generation and demand and reduce constraints on the network. This further reduces operating costs for National Grid ESO, which are passed directly to consumers.

LMP could, however, make investment in renewable electricity generation less attractive in certain areas of the UK. Without appropriate investment support, it would place additional risks on market participants and create market uncertainty due to the radical nature of the reform. This could have positive impacts on investment in new sources of flexibility (such as storage), but negative impacts on renewables ambitions, particularly in Scotland. Policies could be put in place to mitigate these risks. The impact of LMP on renewable energy development in Scotland will be highly sensitive to whether such policies are implemented effectively.

Objectives of the Scottish Government

The Scottish Government outlined key ambitions in the Draft Energy Strategy and Just Transition Plan (ESJTP 2023), amongst other strategy papers. This review was completed before the publication of the final Energy Strategy and Just Transition Plan in 2024.

The review aims to discuss how LMP could impact the Scottish Government in achieving these ambitions. They have been summarised using four broad categories most relevant to wholesale market reform:

- Support ambitions to scale up low-cost renewable energy.

- 8-11GW of offshore wind by 2030 (ambitions from draft ESJTP).

- 20GW of onshore wind by 2030 (ambitions from draft ESJTP).

- Adhere to the principles of a fair and just transition.

- Deliver affordable energy that isn’t subject to global fossil fuel price volatility.

- Enable community participation.

- Incentivise wider economic benefit including jobs, skills, supply chains and investment.

- Support accelerated decarbonisation of heat, transport and industry, including through carbon capture and hydrogen.

- Decarbonise heat and transport using renewable electricity/hydrogen.

- Scale hydrogen generation and develop carbon capture in Scotland.

- Enable a secure and flexible net zero energy system, which is not dependent on fossil fuels.

- Enable energy security through the development of own resources and energy storage.

- Invest in grid infrastructure at pace to allow for a net zero transition.

Key outcomes for wholesale market reform

Wholesale market reform will have widespread impacts on Scotland’s energy strategy, as well as wider social and economic implications. By reviewing Scottish Government strategy papers and assessing where wholesale market reform has significant impact, the authors have developed key outcomes that need to be prioritised for electricity market reform to align with Scotland’s ambitions:

- Strategic coordination of renewable development and network investment is required to ensure that renewables stay in Scotland and net zero is achieved.

- Local price signals are necessary to encourage investment in and optimise the use of flexible assets, such as batteries, and enable an efficient use of renewables.

- Mechanisms that allow electricity users to benefit from low-cost renewable generation are required.

- Benefits and costs of a green transition need to be shared fairly to consumers, communities, and businesses.

Findings

In this section we present the key findings on how LMP and its alternatives could impact Scotland’s energy transition ambitions. This is split into four broad categories:

- The scale up of low-cost renewable energy.

- The fair and just transition.

- The decarbonisation of heat, transport, and industry.

- Enabling a secure and flexible net zero energy system.

Scale up of low-cost renewable energy

LMP would create regional differences in wholesale prices across GB, which depend on local levels of generation and demand. Areas such as the south of England, where demand is higher than supply, would likely see wholesale prices rise. Areas with an oversupply of renewable generation, such as Scotland, would see wholesale prices fall. The primary purpose of LMP is to create a market that is more reflective of the cost of delivering electricity to specific locations on the grid. In doing so, this encourages the placement of generation and demand where it is most suitable and cost-effective for the energy system. The wholesale price signal seen by renewables developers in Scotland could disincentivise investment, as market revenues would decline. Modelling by Aurora (2023) and FTI Consulting (2023) suggest a general southern shift in solar generation, away from Scotland. Changes in the buildout of on- and off-shore wind are more contested due other non-price factors such as the effective on-shore wind ban in England, as well as limited off-shore site availability due to leasing rounds from the Crown Estate. Certain market arrangements could be developed to help shield generators from excessively low local wholesale prices, however this would somewhat diminish the benefit of LMP.

Additionally, LMP introduces a change to the rights of access participants have to the market. Currently, electricity generators can sell electricity on the wholesale market regardless of transmission network constraints. They have firm access rights to the market. Under LMP, generators lose their firm access to the network. As a result, they can only sell their electricity within their zone/node or when it can be transmitted to consumers. This introduces a significant risk for generators in Scotland, as there are times when more electricity is produced from wind in Scotland than can be transmitted to domestic and commercial consumers within Scotland and to the rest of the UK. National Grid has proposed to significantly upgrade the network to 2035, however some excess flows from Scotland are likely to persist even after the new transmission is built.

The new risks created by LMP, combined with additional implementation uncertainty (as a result of reforming wholesale market arrangements), could lead to increases in the cost of capital. The cost of capital reflects the cost of money (e.g. interest on debt) required to finance projects. It represents the return required for an investment to be worthwhile and increases with project risk. As renewables require major upfront investment, the cost of capital has a significant impact on investment levels and the final cost of electricity for consumers. Overall, modelling completed by Aurora (2023), FTI Consulting (2023) and AFRY (2023) shows that small increases in the cost of capital caused by introducing LMP could wipe out any benefits linked to cost savings resulting from LMP.

UK decarbonisation relies on significant renewables capacity in Scotland. As such, the introduction of LMP alone would risk Scottish renewables deployment and therefore GB decarbonisation ambitions. To mitigate this, a possible solution is to reform the renewables support scheme, referred to as Contracts for Difference, to reduce risk in low carbon electricity generation development. This solution must be explored further for possible options and feasibility. Alternatively, improved Transmission Use of System Charges (TNUoS) could provide similar locational investment signals to LMP. These charges are paid by generators and suppliers to recover the cost of installing and maintaining the transmission network. However, reformed TNUoS would lack the operational incentives for flexible assets that LMP could provide.

Fair and just transition

If LMP benefits are realised, the total cost of running the electricity system should decrease moderately as a more efficient electricity system is developed. If these benefits are not offset by increases in the cost of capital for renewables, the modelled annual net economic benefit to the cost of the electricity system lies between £0.2bn-1.6bn (AFRY, 2023; Aurora, 2023).

Due to significant existing renewables capacity, LMP could see Scottish consumers benefitting from wholesale electricity prices lower than current prices as well as prices in other regions of GB. This benefit would reduce over time, though according to one study, Scottish prices would remain as some of the lowest in Europe (FTI Consulting, 2023). As transmission network is reinforced to 2035 and more electricity generation facilities are built closer to where they are needed, prices across GB will converge.

However, initially prices would rise in some areas in GB, although not as much as they would decrease in Scotland (FTI Consulting, 2023). It is possible that some consumer groups, e.g. domestic customers, would be shielded from wholesale prices through arrangements with their electricity retail companies, or UK Government policy design. Additionally, energy suppliers may not pass savings directly to customers, as their costs may rise in other regions. As wholesale electricity prices only constitute a proportion of the domestic electricity bill, with other components including network charges and green levies, the impact of LMP on overall domestic electricity bills will depend on the proportion of the bill that wholesale prices make up at any given time.

Overall, the benefits are more likely to be seen by commercial and industrial consumers in Scotland, who are less likely to be shielded from wholesale prices. The extent to which these benefits are realised depends on when LMP is implemented. The modelling shows the earlier it is implemented, the greater the benefit, as networks are reinforced and become less constrained to 2035 and beyond. However, National Grid ESO suggests LMP will take at least four to eight years for implementation (National Grid ESO, 2022a), limiting the benefits that can be attained.

The development of employment opportunities and other wider economic benefits due to accelerated renewables development is a significant benefit for Scotland. To ensure this, continued development of renewables is necessary through supporting policy. LMP also provides a significant economic opportunity through investment in new demand and industrial sectors. Lower electricity prices could attract investment in sectors such as green hydrogen, data centres or green steel – though none of the reviewed studies directly model this. The Fraser of Allander Institute study (FAI, 2023) shows that the renewable energy sector already supported more than 42,000 jobs across the Scottish economy and generated over £10.1 billion of output in 2021. With decarbonisation seeing the decline of the Scottish oil & gas industry, renewable energy and new demand sectors could provide significant employment opportunities and economic growth.

Decarbonisation of heat, transport and industry

Overall, the modelling in reports published by Aurora (2023) and FTI Consulting (2023) suggests that even if LMP is implemented successfully, it would not significantly affect the pace of decarbonisation of the electricity system. In fact, implementation of LMP without appropriate accompanying mitigations could risk UK decarbonisation efforts through a hiatus in renewable generation investment. The main benefit of LMP is that it could reduce the cost of decarbonisation, especially in Scotland, where the price of electricity could decrease the most.

The electrification of heat and transport is a significant aspect of decarbonisation. Lower wholesale costs under LMP in Scotland can contribute to heat pump and electric vehicle (EV) uptake. This is more likely for heat pumps, as electricity cost is a larger proportion of the total lifetime cost compared to EVs. Analysis by the authors indicates that a 35% reduction in wholesale cost in Scotland would reduce the total cost of ownership of an EV (in years 1-4) by 2%, and 10% for heat pumps. Both still have significant upfront costs that would need to be addressed.

LMP could make the development of green hydrogen more attractive in Scotland. Aurora’s modelling (2023) suggests hydrogen produced in Northern Scotland could have some of the lowest costs in Europe. This is because electricity is one of the main cost components of hydrogen electrolysis. This could generate a hydrogen export economy that could also benefit the decarbonisation of other industrial processes.

Carbon capture on the other hand is not likely to benefit from LMP. The implementation of carbon capture is linked to identifying industrial sites with good transport and carbon storage opportunities.

Enable a secure and flexible net zero energy system

LMP incentivises the optimal location and operation of flexible assets. Flexible assets can shift the consumption or generation of electricity in time or location. The significant capacity of renewable generation in Scotland means that prices in the wholesale market would show significant variation. This would attract investment of flexible assets in Scotland, as operators can access higher revenues. A system with a large proportion of renewable generation requires greater capacity of flexible assets. Such assets relieve network constraints and reduce the overall requirement for generation capacity and network build. Both Aurora (2023) and FTI (2023) show a significant increase in the capacity of battery storage in Scotland due to the implementation of LMP.

Under LMP, the operation of flexible assets is more efficient. A national wholesale market sends the same price signal to all flexible assets, anywhere in the country, regardless of local constraints. This would be improved under LMP, as flexible assets would respond to wholesale price variation, which would reflect local grid requirements. A particular benefit seen is the improved use of interconnectors to other countries. Overall, this enables a cheaper, more secure power system.

Local constraint markets (LCMs) could provide alternative locational signals for flexibility in this respect. LCMs are new electricity markets designed around network constraints. They provide incentives for operators to change their generation/consumption schedules, so that limits on the network are not exceeded. LCMs could, to an extent, replicate LMP market signals for flexibility. However, they would likely create additional barriers and be more complex by creating multiple markets and signals for flexibility to respond to.

Conclusions

The conclusions are based on the authors full independent assessment of the opportunities and threats that LMP and wider electricity market reform could have on the Scottish Government’s ambitions. Based on the findings of this study, the Scottish Government should support the development of a GB-wide strategic plan for renewables and network investment. The Scottish Government should fully explore the implementation of LMP with accompanying reformed support for renewable generation, specifically Contracts for Difference, to ensure continued investment in Scotland.

On the basis of this assessment, the following conclusions are presented in order of importance.

- Scotland must prioritise and coordinate a strategic plan for renewable generation and network reinforcement with the UK Government.

Without support mechanisms for renewables that shield energy generators from LMP, there would be additional risks that disincentivise renewables development in Scotland. Delays to transmission network reinforcement would exacerbate this. Long-term locational signals to strategically locate investment is essential to achieve a low-cost net zero power system. LMP, alongside support mechanisms for renewables, could provide these signals and continue to enable renewables development in Scotland. It is essential that mechanisms such as reformed Contracts for Difference are tested for feasibility before implementation. Alternatively, improved Transmission Network Use of System charges could provide the market with similar signals that indicate the best locations to invest, although this will not improve dispatch signals in the way LMP would.

- LMP would provide the clearest dispatch signal for flexibility, delivering efficient investment in and operation of flexibility.

Maximising the use of renewables can only be done with significant electricity system flexibility. LMP can provide effective investment signals for its development in Scotland and improve operational signals to optimise its use. This would reduce whole system investment requirements in generation capacity and network, reducing bills for consumers. LCMs could be an alternative in this regard, however, could also result in more complex markets and are unlikely to fully replicate the benefits created by LMP.

- The potential benefits of LMP for consumers are greater the earlier it is introduced.

LMP would create the most significant benefit for Scottish consumers before the transmission network is reinforced to 2035, and therefore, would need to be implemented quickly to maximise benefits. The extent to which this can be achieved is limited, as National Grid assumes implementation may take 4-8 years. A well-developed plan to implement LMP is required that accounts for the creation of support mechanisms which protect renewable generation, ensuring benefits are realised.

- Careful implementation of LMP is required to address regional differences in price.

Scottish consumers benefitting from lower wholesale prices would be a clear winner of LMP. However, this is not evenly spread across the rest of GB and must be considered.

Scotland has a clear opportunity to benefit from a net zero power system by making the most of low-cost renewable energy and distributing those benefits to consumers. Proposed changes to wholesale electricity markets could improve system-wide efficiency and offer cheaper electricity in Scotland. However, it could increase risk associated with investment in Scottish renewables, increasing costs. The Scottish Government needs to engage carefully with the electricity market reform process to ensure that prospective benefits are realised, and that potential disbenefits are avoided or mitigated.

© The University of Edinburgh, 2024

Prepared by Environmental Resources Management Ltd. on behalf of ClimateXChange, The University of Edinburgh. All rights reserved.

While every effort is made to ensure the information in this report is accurate, no legal responsibility is accepted for any errors, omissions or misleading statements. The views expressed represent those of the author(s), and do not necessarily represent those of the host institutions or funders.

If you require the report in an alternative format such as a Word document, please contact info@climatexchange.org.uk or 0131 651 4783.

The national price for all generators is set by the most expensive generation selling power on the wholesale market in the period (marginal). ↑