International evidence on fiscal levers to deliver reductions in greenhouse gas emissions

Research completed: January 2024

DOI: http://dx.doi.org/10.7488/era/4033

Executive summary

This study reviewed the use of fiscal levers to reduce greenhouse gas (GHG) emissions across the world. These levers include taxes, levies, duties or charges applied by governments on major sources of emissions.

It focused mainly on direct carbon taxes which are applied to specific goods – typically fuels – based on the amount or intensity of greenhouse gases they produce. It also considered indirect taxes, which place a price on other forms of pollution, such as air or water, but often target GHGs as well. Grants and subsidies are not in scope.

The study examined whether these levers have been effective in decreasing GHG emissions, the revenue that has been raised, and how governments have used that revenue. It looked at six international case studies in more detail. It also examined relevant fiscal levers currently applied in the UK and Scotland, and the possible implications for Scotland of adopting any new lever, based on the case studies. This study does not make policy recommendations, nor does it consider the costs and benefits if they were adopted.

Findings

The study focused mainly on the use of direct carbon taxes both nationally and sub-nationally (in specific regions or provinces within a country) around the world. Key findings are:

- The use of carbon taxes is increasingly common. There are 37 direct carbon taxes in 27 jurisdictions globally, most of them in Europe. Several jurisdictions outside Europe have adopted taxes and more are considering them. About 6% of global GHG emissions are taxed by carbon taxes and this share has increased over the past 15 years. Sub-national carbon taxes have also been applied by Canada and Mexico.

- Taxes differ in terms of GHG coverage and carbon price: We identified three broad categories:

- ‘High ambition’ instruments with both a relatively high price and coverage of GHGs;

- A mixed level of ambition, with either high prices and low coverage; or a high share but low prices;

- Relatively low prices and coverage.

- The balance of evidence suggests carbon taxes have reduced GHG emissions where adopted, but the data is limited, uncertain and rarely quantifies carbon leakage – when businesses transfer production to other countries with laxer emission constraints. Other regulatory measures are likely to be required alongside them to meet wider climate policy goals. There is limited detailed evidence on how affected businesses and households adjust behaviour in response to taxes.

- Carbon taxes have generated government revenue; between several billion dollars in Sweden to tens of million in Iceland. The potential for revenue generation depends on the prevailing carbon price and coverage of the tax, as well as the size of the economy, its carbon intensity and energy mix. They have been relatively straightforward and inexpensive to administer for governments. Some direct carbon taxes have been used to raise revenues for specific purposes. These have typically been channelled towards green technology and specific rebates or tax cuts for affected groups, including low-income households.

- Implementation has been politically challenging. Carbon taxes have been repealed in Australia, delayed in New Zealand and a planned acceleration of the carbon price was suspended in France. A legal challenge was brought in Mexico over whether the regional government had legal authority to implement a proposed tax.

Current fiscal levers in the UK and Scotland

Fiscal levers that target or address GHG emissions focus on energy and energy intensive industries, transportation and resource use. Examples include Fuel Duty, the Climate Change Levy, the Renewable Energy Obligation and the UK Emission Trading System, as well as Air Passenger Duty and vehicle excise duty. A devolved tax, the Air Departure Tax (Scotland) Act 2017, is being progressed, but needs to address the Highland and Islands exemption and safeguard connectivity. The Scottish Landfill Tax applies to waste disposed to landfill.

The introduction of new national devolved taxes can only be delivered by agreement of the Scottish and UK Parliaments or through a change to the devolution settlement. Four of the six case studies have similarities to UK levies, which would need amending, but two would be entirely new. We consider how elements of the case studies could be applied in Scotland but make no recommendations on whether this would be advisable.

Principles for implementation

Any financial lever would be designed based on the six principles in Scotland’s Framework for Tax: proportionality, efficiency, certainty, convenience, engagement and effectiveness. As such, the precise design of any lever would need to be subject to careful consideration and clear communication in terms of its scope, phase-in, price (including future price escalation), sectors and activities on which it is levied and any relevant exemptions. Distributional effects would have to be carefully considered, including if and how revenue should be reallocated, to whom and under what conditions.

Successful fiscal levers have been based on transparent design, regular monitoring and communication of revenues, costs and benefits, with rapid adjustments if unexpected adverse effects occur. They have formed part of wider fiscal reforms, with a clear strategic objective. Any potential options would be required to undergo extensive further consultation and robust impact assessment to fully understand the costs and benefits.

Glossary

|

1tCO2e |

One tonne CO2 equivalent. A metric that allows like for like comparison of carbon intensity |

|

Abatement technologies |

A technological mechanism or process that has the potential to reduce emissions or pollution |

|

Bonus Malus |

Latin for “good-bad”, used to describe an arrangement – or fiscal lever in this case – which alternatively rewards (bonus) and penalises (malus) specific purchasing behaviour. |

|

Carbon leakage |

A potential situation whereby carbon emissions were displaced, in whole or in part, from one jurisdiction to another, as a result of business production relocation in response to specific policies, for example. |

|

CBAM |

Carbon border adjustment mechanism. A fiscal lever which applies a carbo price to certain products imported into a jurisdiction |

|

CCC |

The Climate Change Committee. A statutory body established to advise the UK government and devolved administrations on emission targets, progress made in reducing GHG emissions and preparing for and adapting to the impacts of climate change. |

|

Counterfactual scenario |

Estimates or analysis of what would have occurred without the policy being adopted. It is used widely used in public policy analysis. |

|

Earmarking or hypothecation (of revenues) |

Commitments – whether set out in legislation, policy documents or via political statements – on specific uses of revenue from taxation (for example on tax rebates for low-income groups, of investment in green technologies) |

|

Ex-ante |

Translates from Latin as “before the event”. It refers to evidence based on prediction or forecast. |

|

Ex-post |

Translates from Latin as “after the fact”. It refers to evidence based on what actually occurred. |

|

ETS |

Emission trading scheme or emission trading system |

|

Fiscal levers |

An intervention or policy used by governments to affect financial revenue generated via taxes, duties, levies, charges (or fees). In this study the scope of the term excludes grants and subsidies. |

|

GHG |

Greenhouse gases, i.e., gases present in the earth’s atmosphere that trap heat. Examples include carbon dioxide (CO2), methane and industrial fluorinated gases hydro fluorocarbons (HFC, perfluorocarbons (PFC). |

|

IPCC |

Intergovernmental Panel on Climate Change. The United Nations expert body for assessing the science related to climate change. |

|

Negative externalities |

Where the social costs of a market transaction are greater than the private costs (for example air passengers may not pay the full costs of the damage from the carbon emission associated with their flight). |

|

Price elasticity of demand and supply |

An economic concept concerned with if, and to what extent, demand or supply of a good or service changes when its price does. It is calculated by observing changes in quantity of a good or service demanded (supplied), divided by the change in its price. Inelastic in this context means that demand (supply) does not change when prices do. |

|

Progressive and regressive taxation |

Terms which refer to the effects of specific taxes based on a person’s or a household’s income. Progressive refers to taxes which increase as a person’s income increases, for example income tax. Regressive taxes are applied uniformly, irrespective of income. The tax would then take a larger share of income from lower earners than from higher. For example, VAT is applied uniformly. |

Introduction

Scotland has a legally binding target to reach “net zero” by 2045, as well as annual climate targets. “Net zero” means reducing carbon emissions to almost zero, with any remaining emissions absorbed by nature (such as via forests) or by technologies (such as carbon capture and storage). Rapid transformation across Scotland’s economy and society is required to meet this goal and the Climate Change Plan sets out a pathway and policies to deliver the targets. The Scottish Government has also committed to a just transition, which endeavours to make rapid decarbonisation beneficial and positive for society. There is currently a gap in our evidence base on the potential role for fiscal levers to deliver reductions in greenhouse gas emissions. For the purposes of this study, we define fiscal levers as taxes, levies, duties, or charges. The use of subsidies, grants and loans are not in scope of this work.

We summarise the results of a targeted evidence review on the international use of fiscal levers seeking to reduce GHG emissions, which have either been considered or adopted by national or sub-national governments. We examine the evidence for how well certain fiscal levers have worked internationally, both in terms of reducing emissions of GHGs and in raising government revenue. We analyse six case studies in detail. After reviewing existing fiscal levers in Scotland, we also assess the potential implications for Scotland.

This report should not be interpreted to mean the Scottish Government intends to adopt the examples analysed in this report, nor any fiscal lever. The purpose is to provide an evidence base for the Scottish Government in their consideration of policy action as part of a strategic approach to climate change mitigation.

Overview of methodology

We conducted a targeted literature review of the global use of fiscal levers currently in place – or being considered – that seek to reduce GHG emissions, either directly or indirectly. We then selected six case study examples that were judged to be relevant to Scotland for further exploration. We conducted semi-structured interviews with academics and technical specialists and with experts in the case study jurisdictions to obtain greater insights. We also conducted a high-level review of existing environmental fiscal levers in the UK (including energy, transport and pollution or resources taxes), focusing the analysis on those that deliver reductions in GHG emissions. This was to help understand whether the six case study examples could be implemented by the Scottish Government under current devolved competencies, or whether their adoption would require joint action with the UK Government. More detail on the methodology we used is in Appendix A.

This approach has limitations. The project was undertaken over a short period, between July and October 2023. As such, the report presents selected results of a targeted search of a large secondary literature supplemented by the interviews referred to above, and it has not been possible to examine all issues in detail. No economic modelling has been undertaken on the potential scope or effects of the levers identified.

The use of fiscal levers for GHG emission reductions

Given the size of the literature and the complexity of the issues involved, we have simplified the review into a smaller number of lever typologies and identified lessons learned via successes and challenges encountered. The information in this chapter is drawn from secondary literature and a small number of targeted interviews with subject matter experts.

We have defined fiscal levers as a tax, duty, levy or charge. Typically enacted by a national or sub-national government, they seek to induce changes in behaviour of companies and consumers via changes in the prices of goods and services. This is sometimes referred to as ‘carbon pricing’, which means levers which apply a price to GHG emissions with the intention of reducing them. Carbon pricing can provide an effective and cost-efficient approach to reducing GHG emissions in multiple economic sectors. They do so by incentivising changes in behaviour, via changes in prices, on both the supply side (i.e., amongst the suppliers of goods and services to invest in new abatement technologies or more efficient processes or products) as well as the demand side (i.e., among consumers in their purchasing choices). They also have the potential to raise government revenue.

Economists often refer to GHGs (and other forms of pollution) as negative externalities. This is a type of market failure where the social costs (in this case the damages caused by climate change to current and future generations) are greater than the private costs from specific transactions (i.e., one only pays for the fuel, not the harm from emissions when filling a tank of petrol). A carbon price is a way of correcting the market failure by ensuring those wider costs are captured or ‘internalised’ in transactions (Coyle, 2020).

The scope of this study does not extend to any assessment of the use of grants and subsidies, including so called “environmentally harmful subsidies” (World Bank, 2023a). These have been considered in Scotland in separate work (Blackburn, 2022).

Typologies of fiscal levers

We developed a list of typologies of fiscal levers to enable their effectiveness to be assessed. We have taken a simple approach to aid clarity, and therefore define five broad types of fiscal lever for this study. These are broadly in line with the categories used by the World Bank (2023b). The types of lever are:

Direct taxation schemes

These are taxes which provide a direct price signal and have the explicit aim to reduce GHG emissions, often referred to in the literature as ‘carbon taxes’. They are levied on emissions, for example £ per tonne of CO2 equivalent (tCO₂e), or on £ on emissions per litre of fuel. Costs incurred increase in direct proportion to emissions, but costs may be reduced or avoided by changes to production processes or purchasing decisions, where feasible. In practice all such direct taxes are applied only to certain sectors or economic activities, with various exemptions. Given that the focus of the work are levers to reduce GHG emissions, we have focused our research on direct taxes, where the link to GHG reduction is clearest.

Indirect taxation schemes

These are taxes which provide an indirect price signal and may have multiple aims, which include addressing GHGs as well as other forms of pollution, such as air or water pollution. The tax may be applied on a range of activities but are not directly proportionate to embodied GHGs.As such there is a much wider range of such taxes in operation.We summarise such schemes at a high-level.

Carbon credit schemes

These are systems where tradable carbon credits (again typically representing 1tCO2e) can be generated via voluntary emission reduction activities. Such activities are varied and can include emission avoidance as well as removal, for example tree planting, or carbon capture and storage activities. These credits can be sold (either by businesses achieving the credits or the organisation that administers the scheme). Demand for such credits (and hence value) are generated via the requirements of other carbon pricing or climate change mitigation policies. These are discussed further below, but our research indicates they offer limited potential for revenue raising by a host government, so are not prioritised in this study.

Emission Trading Scheme (ETS)

A Government places a limit on the mass of GHG emissions from the affected entity (usually businesses within a defined economic sector, or undertaking specific economic activities, e.g. agriculture, or aviation) defined in the legislation. Emissions units or allowances, typically representing one tonne of CO2 equivalent (1tCO2e), are typically auctioned to businesses. These can be traded to enable them to emit GHGs, within a given period. The price from the auction and/or a traded second market represents the price of carbon. There are two main types of ETS:

- Cap and trade ETS: Governments set a cap on total GHG emissions from one or more economic sectors (or specific entities). They then sell allowances, typically in auctions, or distribute them for free (or a combination of both) up to the level of the cap. The cap (or the number of free allowances) may be progressively reduced. The European Union (EU) and UK ETSs are examples.

- Rate based ETS: Here the total emissions are not fixed, but entities are allocated a performance benchmark (typically based on the emission intensity of their output). This then serves as a limit on net emissions. Emission allowances can be earned where entities’ emissions are lower than the benchmark and these can then be traded with those who exceed it. The China national ETS system is an example.

The UK ETS replaced the UK’s participation in the EU ETS on 1 January 2021. The UK ETS applies in England, Scotland, Wales and Northern Ireland, whose governments comprise the UK ETS Authority. In Scotland, the Scottish Environment Protection Agency (SEPA) administer the scheme (UK Gov, 2023a). The UK ETS was originally based on the EU ETS but has since diverged in structure and operation. Given that Scotland currently has an ETS system, further research on such schemes have not been prioritised in the current research. However, in some jurisdictions, national governments have applied domestic ETS to additional sectors not covered by, for the example, the EU scheme. We refer to these as ‘national ETS’. These are included in the research as they could potentially be applied in Scotland.

Carbon border adjustment mechanism (CBAM)

These are policy mechanisms which impose a carbon price at the border on embodied emissions in specific goods imported from elsewhere. These seek to ensure a level playing field between the carbon price imposed via domestic legislation (such as via an ETS) and goods produced outside that jurisdiction as well as mitigate the risk of carbon leakage (i.e., displacement of carbon intensive activities outside of regulated jurisdiction) which may lead to a lower level of emission reduction overall.

The EU CBAM entered a transitional phase in October 2023. This is aligned with the phase-out of the allocation of free allowances under the EU ETS. The first reporting period ends on the 31st January 2024 (European Commission, 2023).

The UK Government is considering a range of further potential policy measures to mitigate the risk of carbon leakage in future. One such policy being considered is a UK CBAM. A consultation on these options was conducted jointly by HM Treasury and the Department of Energy Security and Net Zero between the 30th March and 22nd June 2023. The UK Government is currently considering these responses (UK Gov, 2023b). As such, this review does not focus on CBAM measures in other jurisdictions.

Direct taxation schemes

We used data from the World Bank carbon pricing dashboard (World Bank 2023c) to provide an overview of the characteristics of direct carbon pricing instruments as of March 2023. This dashboard identifies a total of 73 such instruments implemented in 39 national jurisdictions across the world. Together, these cover 11.6 gigatonnes CO2e (GtCO2e) of emissions (23% of global GHG emissions). Of these, 37 instruments are direct carbon tax instruments, the remainder are ETS instruments. These carbon taxes have been implemented in 27 national jurisdictions and they cover 2.7 GtCO2e about 5.6% of global GHG emissions. Several trends are evident from these data.

The vast majority of direct carbon tax instruments in operation are in high-income countries, particularly Europe. In terms of timescales for adoption the earliest adopters of national carbon tax instruments in the 1990s are in Northern Europe (Finland, Sweden, Norway, Denmark) but also Poland. The 2000s saw modest further adoption, with only Estonia, Latvia, Switzerland, Ireland and Iceland adopting national carbon tax instruments by 2010. Thereafter, several further European and Non-European countries adopted instruments (the UK Carbon Price Support and carbon taxes in France, Portugal, Spain, Ukraine, Japan and Mexico). These were followed relatively quickly by carbon taxes in Argentina, Chile, Colombia, then Canada, Singapore and South Africa.

In several jurisdictions, carbon taxes have been applied alongside national (or supranational) ETS instruments. These include several in EU Member States (including the UK at the time), as well as Mexico and Canada.

There are only two jurisdictions where sub-national carbon taxes are in operation. There are a total of five in Canada: British Columbia (BC) which was the first subnational carbon tax anywhere in the world; Northwest Territories; Newfoundland and Labrador; New Brunswick and Prince Edward Island. Mexico has several such instruments, the Zacatecas carbon tax, and instruments in Queretaro and Yucatan, for example. In both cases, these are applied alongside a national carbon pricing mechanism; the Canadian federal fuel charge and the Mexican carbon tax, respectively. As would be the case in Scotland, they are also applied alongside an ETS instrument (the Canadian Federal Output based Pricing System (OBPS) and the Mexican pilot ETS, respectively.

Recently, several further jurisdictions are considering instruments. These include the New Zealand agricultural carbon tax, and taxes in Indonesia and three African states: Botswana, Senegal and Morocco. Manitoba in Canada, Mexico (Jalisco), Catalonia and Hawaii are considering new subnational instruments.

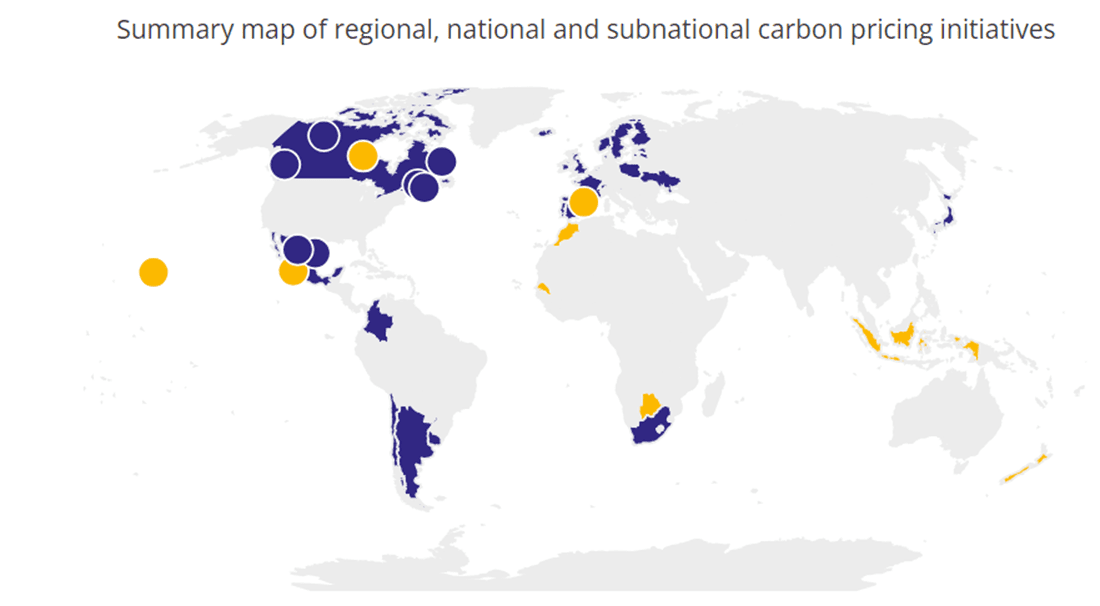

Figure 3.1 provides a visual overview of carbon taxes that are either implemented (in operation), scheduled for implementation (adopted in legislation with an official start date) or under consideration (the relevant government has announced its intention to work toward an initiative). Those that are implemented or scheduled are in blue; those under consideration – four subnational taxes and five national – are in yellow.

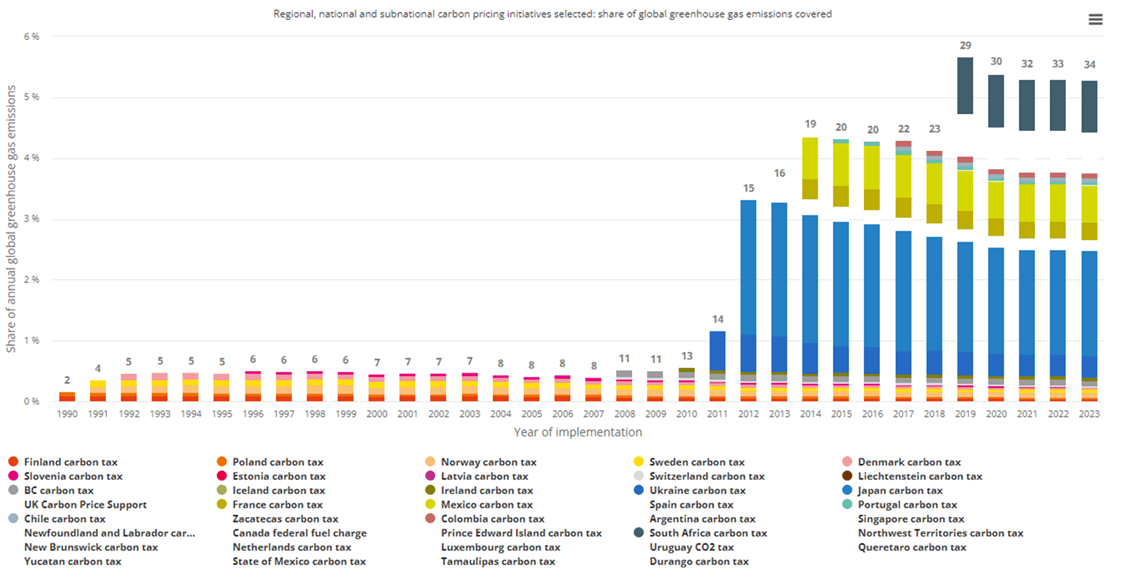

Figure 8.1 (Appendix C) provides time series data on the share of global GHGs covered in the various carbon tax instruments between 1990 and 2023. This provides an indication of the overall significance of their use globally. Note, due to data limitations the share of emissions shown in the figure from 2015 onwards is based on 2015 global emissions data. Several trends are evident, based on these data:

- As of March 2023, carbon tax instruments covered 5.4% of global GHG emissions. This was slightly down from a peak in 2019 of 5.7%. This is likely to reflect reductions in GHG emissions associated with mandatory lockdowns during the Covid-19 pandemic, alongside some emission reductions in at least some jurisdictions.

- Increases in coverage are evident in the last 15 years, arising from the introduction of new instruments in 2011 (Ukraine), 2012 (Japan), 2014 (France and Mexico), and 2019 (South Africa).

- Over the same period however, total global GHG emissions increased by around 50%, from about 31 million kilotonnes of CO₂e (ktCO₂e) in 1990 to over 46 million in 2020 (latest data). Whilst there are some uncertainties in the data, the overall rate of increase in global GHG does appear to have slowed after 2013 (World Bank 2023d).[1]

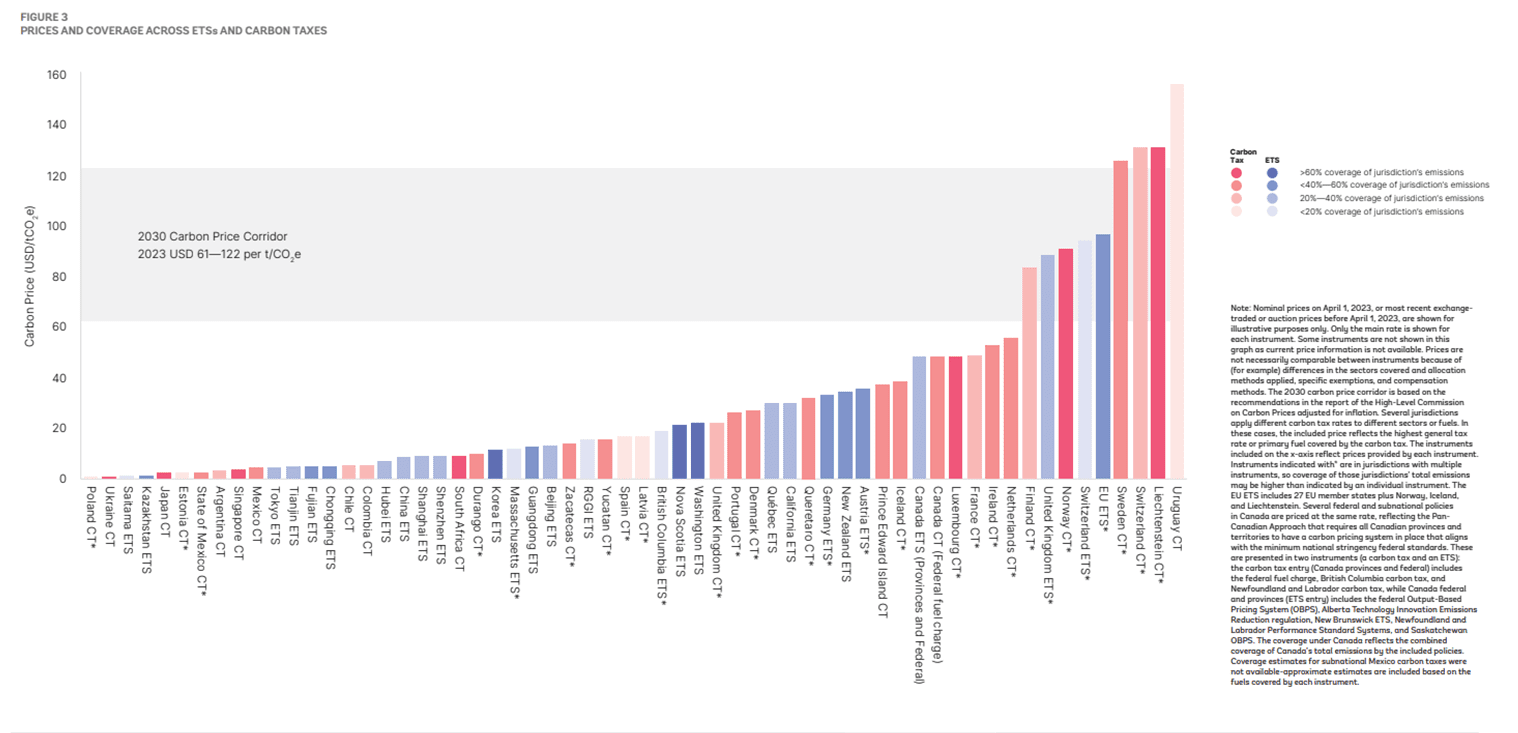

In terms of overall ambition for the carbon tax instrument, Figure 8.2 (Appendix C) presents data from March 2023 which compares the carbon price (in US Dollars per tCO₂e) with the share of GHG emissions that are covered by the relevant tax. The figure also shows ETSs for comparison. These data highlight that existing instruments vary in both price and coverage. Overall, we can identify three broad groupings based on the overall level of ambition of existing instruments:

- High ambition: those with relatively high carbon prices and relatively broad coverage as a proportion of total GHG emissions in that jurisdiction. The carbon taxes in Liechtenstein, Sweden, Switzerland, Norway and Finland are such examples.

- Mixed ambition: this is a larger group with some trade-offs apparent between share or price. For example, Uruguay’s carbon tax, levied on gasoline, provides the highest carbon price but only covers a small share (less than 20% of relevant GHGs). Conversely, Singapore and Japan have wider coverage but a lower price. Others have middling coverage and price, for example France, Canada’s federal fuel charge, Iceland, Denmark and Portugal.

- Low ambition: a smaller group with relatively low prices and coverage. For example, Poland, Estonia, Argentina, Chile and Colombia.

Indirect taxation schemes

The World Bank (2023) defines indirect carbon pricing as other policies which might change the price of products associated with GHG emissions, but they do so in ways not directly proportional to the emissions associated with those products. So these levers do not tax carbon or tax at a rate proportionate to carbon content. Rather, they tax carbon intensive activities or services (or focus on other forms of pollution, such as air pollution, which also has the benefit of producing GHG reductions alongside), hence indirectly create a carbon price signal and encouraging the reduction of GHG emissions. Indirect taxation schemes are therefore very broad. As such, the World Bank (2023c) note that indirect carbon pricing policies are far more common and wide-ranging than direct pricing. This diversity and the weaker causal link with reductions in GHG emissions present a challenge for assessing their effectiveness in this study. As a result, we have given them a lower priority than direct taxation schemes for the purposes of the evidence review.

Examples of indirect taxes exist across many different sectors. They include landfill taxes, such as those in place in Bulgaria (EEA 2022a) and Austria (IEEP, 2016a) or ‘pay as you throw’, schemes for example in Lithuania (EEA 2022b). Pay as you throw schemes are designed to incentivise citizens to separate their waste at source and charge a fee for the collection of residual waste from households.

France has a ‘General Tax on polluting activities’ which applies to companies which are engaged in the storage, thermal treatment or transfer of non-hazardous and hazardous waste (French Ministry of Finance 2023). Latvia employs a National Resources Tax (Latvian Ministry of Finance, 2020), which applies to the extraction of natural resources, environmental pollution, disposal and use of hazardous goods as well as the packaging used in business activities.

In the field of air quality, levers include the Bonus Malus Scheme in France (see Section 8.9 for further detail), air pollution load charge in Hungary, which applies to emissions of nitrogen oxides, sulphur dioxides and non-toxic dust (IEEP 2016b) and a tax on emissions of SO2 and NO2 in Galicia, Spain (Xunta de Galacia, nd). Other levers include an incentive fee on volatile organic compounds as is in place in Switzerland, and a Pesticide Tax (Sweden and Denmark).

Finland also employs a tax on peat use for energy. However, this represents a unique situation as peat is in fact subsidised in comparison to the tax rates of other fuels, and peat makes up a significant part of Finland’s energy mix.

Carbon credit schemes

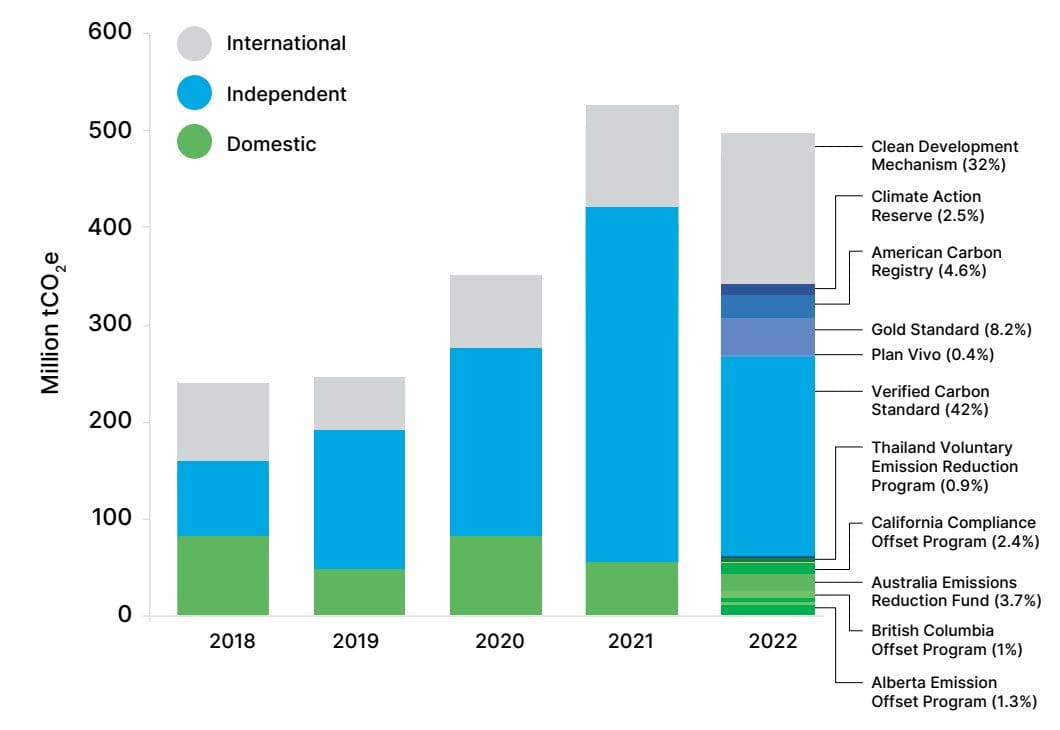

We have used data from the World Bank carbon pricing dashboard (World Bank 2023c) to provide an overview of carbon credit schemes, their use, prominence in global trading, and role in international climate agreements.

Carbon credits are units that represent emission reduction activities that include either avoiding the carbon being produced (e.g., capturing methane from landfills), or removing carbon from atmosphere (e.g., sequestering carbon through planting trees or directly capturing carbon from the air and storing it). One credit is typically equivalent to one metric tonne of a carbon dioxide equivalent (tCO₂e) reduced or removed.

Carbon credit schemes create opportunities for investors and corporations to trade carbon credits. The carbon credit market has grown significantly since the concept was establish alongside the 1997 Kyoto Protocol. It experienced a further surge in interest following the Paris Agreement of 2015, more than doubling in size over five years (Dyck, 2022), though the sector grew less between 2021 and 2022, reflecting challenging economic conditions and criticism of the integrity of some schemes (World Bank 2023c). Carbon credits are supplied via regional, sub-national and national governments (such as the California Compliance Offset Program), at international scale through international treaties (such as the Kyoto Protocol and the Paris Agreement), and independently, via non-governmental entities (such as Gold Standard). The largest share of carbon credits is issued via independent non-governmental mechanisms, which had driven much of the overall growth seen between 2018 and 202.1 Figure 8.3 in Appendix C provides more detail.

The biggest driver for demand on carbon credits is companies purchasing credits, usually from independent suppliers, to compensate for emissions-heavy activities, either voluntarily or in response to regulation. However, carbon credits can be controversial because it is not always clear that carbon has in fact been saved or stored, and there are concerns with the ways in which schemes are set up, managed and promoted. The carbon credit market is currently evolving to respond to these concerns (Donaho, 2023).

Effectiveness of fiscal levers

We interpret effectiveness as the extent to which the policy has achieved its desired objectives and reached the affected group(s) (Scot Gov, 2018), compared to the starting (or baseline) position (i.e. has the instrument led to decreases in GHG emissions in the sector or activities targeted). We have also considered the extent to which impacts can be attributed to the policy in question, compared to other factors. We focus on the available secondary evidence and on direct tax examples. We have sought evidence on policy objectives of interest to the Scottish Government; namely the extent to which the instruments have resulted in GHG emission reductions, preferably where these have been quantified and attributed to the tax, and the extent to which they have generated revenues for the host government. Where possible, we consider whether the policy has brought about behaviour change in response to the tax. We have also considered data on the revenues that the tax has created, as well as how that revenue has been used by the host government. Other unintended impacts are noted, where evidence allows.

Before we consider data from specific instruments, a key broader conclusion is that several sources do not consider that existing carbon tax instruments are sufficient to address climate change goals. The Intergovernmental Panel on Climate Change (IPCC) estimated that to meet global GHG reduction requirements the average G20 economy needs to reduce its GHG emissions by over 10% every year (Green, 2021). The sources above suggests that the price and scope of existing instruments are not sufficient to deliver this kind of reduction.

Evidence on effectiveness – GHG emissions and behaviour change

In analysing the literature, we looked for secondary evidence on the overall effectiveness of different fiscal levers. Our assessment was limited by two key factors. First, it is not always possible to attribute GHG reductions to one policy instrument, compared to the various other factors influencing GHG emissions and all such estimates are subject to uncertainty. Possible other factors include rates of overall economic growth, growth within sectors, economic structure (i.e., size of emission intensive sectors and trends within these), imports and exports, as well as economic shocks such as recessions, the Covid-19 pandemic, and the Russian invasion of Ukraine. Similarly, there are several policies that may affect GHG emissions, so it can be difficult to ascribe GHG reduction to one climate-related policy over another. Second, there is a time lag between policy implementation and observed changes which, in this case, limits the available evidence.

Overall, the balance of evidence suggests that the fiscal levers reviewed have reduced GHG emissions in the relevant jurisdictions, but the precise reduction is unclear. A 2021 review (Green, 2021) collated available quantitative ex post evidence on GHG emissions reductions attributed to either ETSs or carbon taxes.[2] Key findings are below (note further detail is provided in Table 8.1 in Appendix C, which contains discussion on the findings of several specific studies, including quantitative GHG emission reduction estimates).

- Although carbon pricing has dominated many political discussions of climate change, only 37 studies assess the actual effects of the policy on emission reductions. Of these, the vast majority are focused on European examples. In turn, most of these examples focus on ETSs, rather than carbon taxes, per se. Similarly, there are few studies which compare either carbon taxes or ETSs to other climate change mitigation policies to establish the relative effectiveness and efficiency of policy measure or packages.

- Most studies suggest that the aggregate reductions from carbon pricing (note this refers to both ETSs and carbon taxes) on emissions are generally limited. The overall reductions observed were on average up to 2% per year (again this refers to both ETSs and carbon taxes). However, there is considerable variation in the GHG reductions seen between sectors.

- In general, the review concluded that the existing evidence suggested carbon taxes may have performed better than ETSs in producing emission reductions. Note this conclusion should be interpreted with caution; it may reflect the prevailing carbon price, rather than the mechanism itself and much of the evidence on emission reductions from ETSs discussed in the review focussed on the EU ETS. Some of the studies on which this conclusion is drawn are based on the pilot phase of the EU ETS, which involved free allocations to several sectors, a higher emissions cap and a relatively low carbon price. Future evidence should be monitored to examine whether that conclusion remains valid.

- However, there is more evidence that other regulatory instruments beyond either ETSs or carbon pricing probably have a greater effect than either measure acting alone. A 2020 study concluded that “the real work of emission control is done through regulatory instruments” (Cullenward and Victor, cited in Green 2021). A 2018 review provides some evidence that nations which are part of the EU ETS and are without a carbon tax experienced emission reduction in those sectors not covered by the ETS at a slightly faster rate than those that applied a domestic carbon tax, alongside the EU ETS (Haites, 2018, cited in Green 2021). There are clearly several factors at play.

- Experience to date indicates that in comparison with ETSs, establishing and administering carbon taxes in the host government are comparatively straightforward and inexpensive.

We have identified limited evidence on the behavioural effects of the taxes. Two studies (Tvinnereim and Mehling 2018, Rosenbloom et al 2020, cited in Green, 2021) consider this. They conclude that there is little evidence that the taxes directly result in wider decarbonisation. The studies suggest a more common response is to mitigate the flow of emissions, via fuel switching or efficiency improvements, rather than more significant changes in manufacturing process or technologies. This may be a product of the nature of the instrument, the activities on which the taxes are targeted or current relatively low prices. It may also reflect a lack of coordination of wider climate mitigation policy, which as we have seen above, is likely to be necessary to sustain wider emission reductions.

Evidence on effectiveness – Revenue generation and ‘hypothecation or earmarking’

We reviewed evidence on both the revenue generated by carbon taxes as well as how these revenues have been used. The available data reflects different time periods and there are some methodological inconsistencies. Two overall conclusions are apparent. First, that carbon taxes have generated substantial income for the host government. Second, that a key characteristic of carbon taxes in operation to date is that a substantial proportion of that revenue is often allocated (or ‘earmarked’ or ‘hypothecated’) for specific purposes. Occasionally this hypothecation is explicit in the legislation, hence legally binding, while in other cases this allocation is via a political commitment, hence potentially subject to change with associated changes in Government.

A 2016 review (Carl and Fedor, 2016) of 56 national or subnational instruments found revenues from carbon pricing (i.e., taxes and ETSs) amounted to $28.3 billion in 2013. Of this, well over $20 billion was raised from carbon taxes.[3] Of this only a small proportion of this revenue overall (about 15% was allocated to ‘green spending’. The review concluded that it was much more common for carbon tax revenues to be reallocated in the form of tax cuts and rebates and this accounted for about 44% of revenues at the time. About 28% were not allocated for a specific purpose, referred to as ‘unconstrained’. The same review indicates indirect taxes are often not reallocated for specific purposes (Carl and Fedor, 2016). Analysis of specific carbon tax instruments were also included, with results shown in Table 8.2 in Appendix C. These data indicate that taxes accounted for revenues between $30 million per year (Iceland) to $1 billion or more (Denmark, British Columbia and Norway). Sweden’s is by far the largest at $3.5 billion and it also has the largest per capita cost and share of GDP. These data indicate – at the time – that the most ambitious schemes constitute well under 1% of GDP. Further quantitative data is set out in Table 8.2 in Appendix C.

More recent data show that by 2022 (World Bank 2023), revenues from carbon pricing had increased significantly to $95 billion, of which carbon taxes generated 31% (just under $30 billion).[4] Although revenues from carbon taxes had increased, this had been driven by rising revenues from ETSs. The overall tax revenue is not just a by-product of prices, but of the share of GHG emission covered, exemptions, the carbon intensity of sectors, and carbon leakage. For example, South Africa’s carbon tax covers nearly 10 times more emissions than Colombia’s and at a higher rate but was delivering a similar amount of revenues (World Bank 2023).

For comparison, a more recent study based on 40 countries also examined the level and use of revenue (OECD, 2019). This source examines whether the revenue reallocations were legally binding (i.e., set out in the relevant legislative act) or based on a political commitment (i.e., via ministerial or policy statement). The review also provides further detail on precisely how the revenues have been used. These full data are produced in Table 8.3 in Appendix C.

Again, the data show that a consistent feature of carbon taxes is the extent to which the revenues are used for specific purposes; around two thirds of total revenues have some form of hypothecation or constraint. They have been particularly directed toward reducing the taxation burden in other spheres, such as associated with employment or in provision of direct financial relief or subsidy to specific groups. Moreover, the review found that introduction of carbon taxes has frequently been part of broader tax reforms and that it has been more common for carbon tax revenue to be allocated based on political, rather than legal commitments. The authors indicate that the tax reform potential of carbon taxes (i.e., reducing the tax liabilities from labour and capital) may form part of the motivation for adoption, alongside the climate mitigation potential in at least some jurisdictions (OECD, (2019).

Lessons learned

We reviewed evidence on where carbon taxes have been effective, as well as where setbacks have occurred and why. We highlight data gaps and conclude with recommendations identified in the literature on how a hypothetical UK carbon tax might be applied.

Are carbon taxes regressive?

A small number of studies have explicitly reviewed the evidence on distributional effects from carbon taxes (i.e., to whom the costs are incurred, with a particular focus on different impacts based on income) and whether carbon pricing results in generally progressive or regressive effects. For example, Ohlendorf et al (2018) provide a meta-review, but the information identified has generally focussed on low and middle-income countries and shown different results. The review notes that literature reviews have shown mostly regressive impacts in developed countries, but that this is not necessarily the case in developing countries. More progressive outcomes were observed for reforms that remove fossil fuel subsidies as well as some transportation policy. Overall, the review is inconclusive and provides limited lessons for Scotland. The tax itself is likely to be regressive, where additional costs incurred via carbon taxes are passed through supply chains to end users or consumers. Without the revenue recycling/rebate measures described above this may disproportionately affect those on the lowest incomes (Ohlendorf et al 2018, LSE, 2019). The UK Government Net Zero Review examines household exposure to the costs associated with the net zero transition. The review concludes that forecasting household costs in detail is not possible, but costs may fall on households via a number of routes. These include via Government decisions on tax and expenditure, via businesses and reflected in prices, wages and consumer choices (HM Treasury, 2021).

What has worked in the application of carbon taxes?

Overall, we found several examples where carbon taxes have been applied, maintained, contributed to emission reduction and generated revenue for the host government, whilst maintaining popular support. However, in every case, the design of the tax has considered the unique context in each jurisdiction.

A significant element of revenue recycling is a characteristic of most instruments adopted to date. An OECD review notes it has been possible, “in most circumstances”, to strike a balance between using the revenue in ways that are socially useful and that contribute to public support for carbon pricing. Such revenue recycling should not be seen as a panacea for public support, however. Introducing carbon pricing instruments generally is seen as more challenging when general public confidence in government is low (note this is not defined and is clearly relative). Such lack of confidence further limits the options for revenue use, by reducing the space for more significant tax reforms and increasing the political appeal for lump sum transfers of revenue (OECD, 2019).

Others have seen the degree of hypothecation of revenues as a way of ensuring ‘lock in’ of the front-end prices and increasing the overall longevity and stability of the instrument. For instance, by ensuring the back-end uses of the proceeds are visible, it is harder to change prices or exempt certain sectors for reasons of political expediency (Carl and Fedor, 2016).

A further balance must be struck between rigid hypothecation of the revenues, which may constrain flexibility, and the benefits of clearly communicating what revenues are being generated and how they are to be used. This communication is considered to be key for creating public support and any policy should be developed in conjunction with stakeholders and be subject to a detailed cost-benefit analysis (OECD, 2019).

Sweden’s carbon tax, for example, may be seen as an exception to this. Some analysis suggests that it has been subject to so many changes that the ultimate effect of the carbon tax is not clearly distinct from effects of other measures e.g., value added tax, excise duties, etc. (Carl and Fedor, 2016). However, what is clear from the Swedish example is that the tax was part of a wider reform which itself had a clear objective (Section 8.6). This may explain at least some of the public support, even with a relatively high carbon price.

The justification made at the time for the introduction of carbon taxes vary and are not confined to emission reduction objectives. For example, reducing taxation in other areas, such as on labour (British Columbia, Sweden) as well as using them for wider fiscal recovery after financial crisis (Ireland, Iceland). Other rationale includes the relative simplicity and stability relative to ETS instruments (Carl and Fedor, 2016).

In the past, carbon taxes have provided a degree of price predictability and of revenue certainty for the host government. For instance, the British Columbia government has been able to predict revenues at least a year ahead within a 5% margin for error (Carl and Fedor, 2016). This would seem to be a feature of the design of the tax (i.e., the sectors at which it is targeted and the overall share of GHG affected).

Gradual introduction of the tax was seen as a positive feature (for example British Columbia), avoiding a sudden increase in the cost base for affected sectors and mitigating unintended consequences. However, they are also seen as visible, tangible and “politically immediate” ways of demonstrating progress toward climate mitigation (Carl and Fedor, 2016, LSE, 2019).

What lessons have been observed in the application of carbon taxes?

It is equally important to draw lessons on where they have not worked or have encountered problems. Reflecting on implementation, we find that existing carbon taxes are generally not sufficient, either in price or scope, to meet existing climate policy goals.

Carbon taxes have also been politically difficult to implement. They have proved controversial in many jurisdictions, including several with similarities to Scotland. Green (2021) suggests this opposition comes from two sources. The first source is the emitting industries themselves. Second, some evidence is presented by Green (2022) that the public tend to prefer other policies to carbon pricing. Use of dividends (i.e., rebates) may mitigate this risk, but only as part of a wider climate change mitigation package of policy.

The review has identified several jurisdictions where significant setbacks have been observed. The clearest case is in Australia where an existing carbon tax policy was cancelled. The tax generated what were at the time the largest overall revenues and per capita costs in the world. This was despite having a carbon price ($30 per tonne as of 2016) which was comparable with other jurisdictions. The revenues were a product of the relative carbon intensity of the country’s – largely coal fired – energy generation infrastructure. Repealing the tax became a key element of the opposition party’s ultimately successful political campaign (Carl and Fedor, 2016).

Mexico is the first Latin American country which has introduced sub-national carbon taxes. Durango is the most recent State to enact one, in January 2023 and others are considering implementing them. Baja California (a Mexican State) introduced a carbon tax as of 2022 as a part of broader fiscal reforms. The tax was levied on emissions from gasoline and diesels. A legal challenge was subsequently brought in Baja California, by the Mexican Federal Government and a group of regulated entities. This argued that under the Mexican Constitution, only the federal government could implement a tax on fuels. The Mexican Supreme Court ruled in favour of the Federal Government (World Bank 2023c).

In France a planned acceleration of the carbon price increase was suspended in 2018. At that point the price was around $50 per tonne. This was in response to a public backlash on the perceived unfairness of the tax, which was introduced at the same time as broader reforms which were perceived as benefiting the wealthy (IMF, 2019). The wider backlash was epitomised by the ‘gilets jaunes’ or ‘yellow vests’ protests about fuel prices.

There are other examples where the instruments have been adjusted, paused, amended or the price escalator has been delayed or otherwise changed. For example, British Columbia and particularly New Zealand, where a proposed ‘fart tax’ was cancelled and an agricultural tax has been delayed (see Section 3.7.4).

A specific challenge is that the UK – and by implication, Scotland – has one of the most complex tax systems in the world. Some experts have consistently criticised a lack of an overall coherent tax strategy for the UK, particularly considering the implications of demographic changes for future taxation targeted at the economically active working age population (Johnson, 2023).

What are the data gaps?

Our review and the interviews have generated limited specific detail on impacts within affected sectors, as well as details on the behavioural response of those sectors. This reflects methodological challenges as well as time lags between policy action and observed effects. It has also identified limited quantitative information on carbon leakage. The emission reduction estimates are likely to be somewhat overstated, given that this has not been quantified.

Recommendations for the UK in the literature

A 2019 policy brief from the Grantham Institute reviewed the global evidence and provided a series of explicit recommendations for the UK if it were to implement a carbon tax (LSE, 2019). The recommendations were:

- The tax rate should be high enough to be consistent with net zero policy objectives. This implied a starting rate somewhere around £40 per tonne (as of 2020) (note this also depends on the scope of the tax, which is not specified in detail in the paper, but would need to be applied “in most sectors”). It should complement and be carefully designed alongside other climate change mitigation policies.

- Credibility requires clear rules, a design that is not susceptible to political pressure and visibility on how the trajectory of prices or scope may change over time (i.e., annually, based on factors like investment cycles or emission performance).

- The price should start low and rise over time. This doesn’t only allow affected industries time to respond but allows evidence on effectiveness and any unintended effects to be observed in practice.

- The use of the proceeds should be carefully and regularly explained alongside information on the economic, social and environmental costs and benefits (via a published, independent cost-benefit analysis, for example).

Case studies

To gain further depth on specific international examples of fiscal levers, we assessed six case studies in further detail. Their selection was based on six predetermined criteria (see Section 8.1.2 in Appendix A on the methodology for the overall study for more detail). An overview of the selected case studies, and the accompanying rationale for their selection against these criteria is in Table 3.1, below. Each criterion has been assigned a red [R], amber [A] or green [G] (RAG) rating. This is based on a judgement of the researchers on the overall similarities between the case study jurisdiction and the Scottish context. For comparison, the Scottish population was some 5.4 million (in 2022), whilst GDP per capita was $42,362 (in 2021).[5] Given Scotland’s devolved powers to create taxes with consent of UK Parliament, we include examples where instruments have been applied sub-nationally (for example Canada, Wallonia). There are cases which include rural and island communities or significant renewable energy generation potential (for example New Zealand). Scotland’s ambition is for Net Zero by 2045 and 75% reduction in emission by 2030, so we have selected jurisdictions with similarly ambitious targets (for example Sweden and Austria).

We discuss key features and potential lessons for Scotland in Sections 3.7.1 to 3.7.4 below the table. Full details of the case studies are in Appendix D.

|

British Columbia |

Sweden |

Austria |

New Zealand |

France |

Wallonia | |

|---|---|---|---|---|---|---|

|

Overview of instrument |

Direct carbon tax, applied to fuels based on their CO2 content |

Direct carbon tax, applied to fuels based on a CO2 price per tonne |

National ETS scheme which augments the EU ETS and applies to sectors excluded from it |

Agricultural tax, applying a farm-level levy on GHG emissions |

Bonus Malus scheme with fees on purchase of new emission intensive vehicles and rebates for electric vehicles |

Indirect tax on environmental impacts from farming, focussed on water resources |

|

Population and GDP per capita |

5 million (2021) and $59,962 [G] |

10.5 million (2022) and $65,157 (2021) [A] |

9 million (2022) and $59,991 (2021) [A] |

5.1 million (2022) and $47,982 (2021) [G] |

68 million (2022) $55,064 (2022) [A] |

3.6 million (2022) and €31,568 (2021) [A] |

|

Administrative and legal arrangements/ competencies |

Sub-national tax, with separate federal tax system [G] |

National level tax, alongside EU ETS [A] |

National ETS designed around EU ETS [G] |

A proposed national-level tax [A] |

National level indirect tax [A] |

Indirect tax at sub-national level [G] |

|

Shared challenges |

Significant renewable energy use (largely hydropower), rural communities [G] |

Rapidly growing renewable energy potential, Rural and Island communities [G] |

Rapidly growing renewable energy potential, rural communities [A] |

Significant renewable energy potential, Peatland[G] |

Increasing renewable energy potential, rural communities [G] |

Increasing renewable energy use [G] |

|

Climate ambition |

Net Zero by 2050 [A] |

Net Zero by 2045 [G] |

Net Zero by 2040 [G] |

Net Zero by 2050 [A] |

Net Zero by 2050 [A] |

80-95% reduction in emissions by 2050 [A] |

|

Data and Evidence |

Good level of evidence [G] |

Good level of evidence [G] |

No ex-post evidence, but detail on design/expected impacts [G] |

Implementation lessons only [R] |

Good level of evidence [G] |

Good detail on lever design, limited evidence on effectiveness [A] |

|

Diversity of Approaches |

Sub-national direct carbon tax [G] |

Longstanding and highest priced direct carbon tax [G] |

National level ETS [G] |

Novel concept [G] |

Indirect tax, administered nationally [G] |

Indirect tax, administered at sub-nationally [G] |

Impact on GHG emissions

The available evidence linking each fiscal lever with GHG emission reduction varies significantly. The case studies include two direct taxes – both of which are applied to various fuels based on their CO2 content – in Sweden and British Columbia (BC), Canada. These levers have been in place for a relatively long period, so have generally good ex-post evidence available. Bernard and Kichian (2019) have calculated that the British Columbia carbon tax, once reaching the rate of $30/ton of CO2, achieved an estimated 1.13-million-ton reduction in CO2 emissions. This equates to an average annual reduction of 1.3% relative to British Columbia’s 2008 diesel emissions and 0.2% relative to all BC CO2 emissions in 2008. However, they do not think it is a viable strategy for achieving net zero goals in isolation. With regards to the Swedish carbon tax, a review of ex-post analyses of carbon taxes by Green (2021) reveals different results around Sweden’s emission reductions. For example, research by Andersson (2019) found an average emission reduction of 6.3% per year between 1990 and 2005, Fernando (2019) found an annual average reduction of 17.2% and research by Shmelev and Speck (2018) found no effect on emissions. A study conducted by Jonsson, Ydstedt, & Asen (2022) state that GHG emissions have declined by 27% between 1990 and 2018. This highlights various methodological differences in conducting these ex-post analyses, and the difficulty in establishing the baseline of what emissions reductions would have occurred even in the absence of the lever.

The Austrian national ETS (nETS) – which extends the EU ETS, of which Austria is a part, to other sectors – is still in a phased implementation stage and will establish a set price which increases each year, reaching a market phase in 2026. Ex-ante modelling conducted by the Austrian government expects the scheme to reduce GHG emissions 800,000 tonnes by 2025. The proposed tax on agricultural emissions in New Zealand has not yet been finalised.

The evidence suggests the French Bonus Malus scheme – which incentivises uptake of low emission vehicles with a combination of fees and rebates – has been effective in shifting vehicle sales toward more environmentally friendly vehicles. Even though progress has slowed in recent years, average emissions have reduced significantly from 149 gCO2/km in 2010 to 111 gCO2/km in 2017. The relationship between the agricultural tax in Wallonia – which is applied at a farm level on the effects on water resources from livestock and land cultivation – and GHG emissions is much less clear.

Revenue generation and use

Data availability on revenue generated by these schemes varies. In all cases, a key element has been that revenues are either directly recycled back to citizens or are offset in other parts of the budget. This has occurred via direct payments/rebates to households or implementing other tax cuts alongside the lever.

The British Columbia carbon tax was designed to be revenue neutral and so was implemented alongside a wider scheme of tax cuts, and is now part of the Canadian Federal approach, which gives direct payments back to households. In 2019, SEK 22.2 billion was generated via the Swedish carbon tax, which is approximately 1% of Sweden’s total tax revenue. The carbon tax revenue goes into the overall government budget, and is not hypothecated, thus it is unclear where the revenue generated is distributed (Jonsson, Ydstedt, & Asen, 2022). The Austrian nETS was implemented as part of a wider policy package. Although revenue for the emissions allowances goes directly into the main budget and there is no hypothecation, ‘climate bonus’ payments are given directly back to households. Revenue in 2022 was approximately €800 million and the government have reallocated around €1 billion.

Since 2014, the Bonus Malus scheme has generated surplus revenue for the French general budget. For 2018, the malus was set at a level that covered the costs of the bonus payments (EUR 261 million) and the additional bonus for scrapped vehicles (EUR 127 million). The agricultural tax in Wallonia generates an annual revenue of around €1.2 million, however, it is unclear how this is subsequently used.

Behaviour change

There is some evidence on how the case study examples influence behaviour change. The carbon tax in British Columbia has been shown to have had a role in decreasing consumer demand for fossil fuels and natural gas (Pretis, 2022). Additional studies from Xiang and Lawley (2018) and Antweiler and Gulati (2016) also draw correlations between the implementation of the tax and a decrease in fuel demand.

The carbon tax in Sweden has shown to be effective in shifting market investment into low-carbon technology, specifically in renewable energy sources such as hydro and wind (Hildingsson and Knaggård, 2022). Levying the carbon tax at different rates on fuels has also resulted in behaviour changes in companies. Between 1993 and 1997, the higher tax rate on fuels used within domestic heating systems compared to fuels used within industry resulted in industries selling their by-products to domestic heating companies, while continuing to burn fossil fuels themselves (Johansson, 2000).

One interviewee suggested that the Austrian nETS, whilst in its fixed price stage, is not expected to generate a strong enough price signal to result in a clear and significant change in behaviour. However, other parts of the policy package have been designed to specifically change behaviour (such as subsidies for changing heating systems in households). The Bonus Malus scheme has had a clear impact on shifting vehicle sales in France towards less CO2 intensive vehicles. However, the scheme may have a rebound effect, as the lower fuel expenditure for consumers due to more efficient vehicles may lead to an increase in vehicle use and thus in fuel consumed (and thus on emissions). There is no evidence regarding the behavioural effects of the agricultural tax in Wallonia.

Unexpected challenges

In British Columbia, the tax was initially designed without exemptions and applied universally. However, after competitiveness concerns were raised, the government introduced a one-time exemption worth $7.6 million in 2012, followed by an ongoing exemption in 2013 to greenhouse growers and an exemption for gasoline and diesel used in agriculture in 2014.

When implementing their nETS, the Austrian government experienced challenges designing the scheme around the existing EU ETS. To ensure that emissions were not double counted, exemptions from the national ETS were given to installations already regulated under the EU ETS. This proved a challenging exercise for the Austrian government.

Challenges have been observed for the proposed agricultural tax in New Zealand. Whilst these are political in nature, they have presented challenges for the implementing government. The original proposal for a split-gas, farm-level levy was revoked after a consultation highlighted public concerns about the impact on the cost and potential implications on availability of produce. A series of media outlets reported tensions between the agricultural sector in New Zealand and the government. Farmers expressed concerns regarding both the profitability and competitiveness of their business, with some expecting to have to reduce their herd size (Pannett, 2023). After revoking the original planned tax, the NZ government are now implementing mandatory monitoring and reporting of emissions from agriculture, to eventually transition into pricing of emissions.

Overview of fiscal levers in the UK

We investigated existing UK environmental fiscal levers, including taxes in the energy intensive industries, the power generation, transport, and pollution and resource sectors in Appendix B. We focused analysis on those that deliver reductions in GHG emissions. These include:

- Fiscal levers specifically targeted to reduce GHG emissions.

- Fiscal levers specifically targeted to address environmental impacts and affecting GHG emissions.

These were classified using the typologies developed in Section 3.1. Fiscal levers that do not contribute to reducing GHG emissions have not been considered. A complete list of environmental taxes in the UK (at time of writing) is in Section 8.1.4.

Existing fiscal levers which target or address GHG emissions focus on energy and energy intensive industries, transportation (road and air transport) and resource use. Examples include Fuel Duty, the Climate Change Levy (CCL), the Renewables Obligation (RO), the UK ETS, the UK Air Passenger Duty (APD), and the Vehicle Excise Duty (VED).

Under the current devolution settlement, most tax powers remain reserved to the UK Government and Parliament. However, any existing national tax can potentially be devolved to the Scottish Parliament. New national taxes can be created through a mechanism allowing the UK Parliament, with the consent of the Scottish Parliament, to grant powers for new national devolved taxes to be created in Scotland (Scottish Parliament, 2021).

Overview of fiscal levers in Scotland and implications of the case studies

Devolution is the statutory delegation of powers from the central government of a sovereign state to govern at a subnational level. It is a form of administrative decentralisation. Devolved territories have the power to make legislation relevant to the area, thus granting them higher levels of autonomy. In the UK, devolution is the term used to describe the process of transferring power from the centre (Westminster) to the nations and regions of the United Kingdom (Torrance, 2022). Devolution provides Scotland, Wales and Northern Ireland with forms of self-government within the UK. In the case of Scotland, this includes the transfer of legislative powers to the Scottish Parliament and the granting of powers to the Scottish Government. While the UK Parliament still legislates for Scotland, it does not do so for devolved matters without the consent of the Scottish Parliament.

The devolution process has led to calls for the Scottish Parliament to be given more responsibility over revenue raised and spent in Scotland. There are existing devolved environmental taxes under the Scottish Government’s remit that contribute to reducing GHG emissions. We have also considered implications of the case studies from a legal and regulatory perspective. No assessment is made of the potential costs and benefits of adoption nor of the practical challenges associated with them.

Legal and regulatory fiscal system in Scotland

The legislative framework for devolution to Scotland was originally set out in the Scotland Act 1998. The Scotland Act 1998 established the Scottish Parliament and set out the matters on which the Scottish Parliament cannot legislate and make laws, known as general and specific reservations. Everything not listed as a reserved matter is assumed to be devolved. Reserved taxation matters include VAT rates, Fuel Duty, and Corporation Tax. The Scottish Parliament currently has devolved responsibilities in relation to five taxes (Scottish Government (2021), as follows:

- Scottish Income Tax, which is partially devolved. It is collected and administered by HMRC on behalf of the Scottish Government.

- Land and Buildings Transaction Tax, a tax paid in relation to land and property transactions in Scotland, and Scottish Landfill Tax, a tax on the disposal of waste to landfill, are fully devolved national taxes and are managed and collected by Revenue Scotland.

- The Scottish Parliament also has powers over local taxes for local expenditure. Currently, the two main local taxes are Council Tax and Non-Domestic Rates (also known as business rates), which are collected by local authorities. Note that a review of local taxes is not covered in this study.

In addition, powers in relation to two further taxes have been devolved to the Scottish Parliament, but these have not yet been implemented and the relevant reserved taxes therefore continue to apply. These taxes are Air Departure Tax, a tax on all eligible passengers flying from Scottish airports, which will replace Air Passenger Duty when introduced, and a devolved tax on the commercial exploitation of crushed rock, gravel, or sand, which will replace the Aggregates Levy when introduced.

The Scottish Parliament has the power to create new local taxes (i.e. local taxes to fund local authority expenditure). There is also a mechanism allowing the UK Parliament, with the consent of the Scottish Parliament, to devolve powers for new national devolved taxes to be created in Scotland. This is unlikely to be a swift process and would likely depend on the complexity of the new national tax and negotiation over devolution of the requisite powers.

The UK Internal Market Act 2020 (IMA) seeks to prevent internal trade barriers among the four countries of the United Kingdom. Schedule 1, paragraph 11 of the IMA specifically exempts taxes (Legislation.gov.uk, 2020a). However, new regulatory acts considered to create additional administrative burdens which may affect intra UK trade may be challenged under the IMA.

Devolved fiscal levers to deliver reductions in GHG emissions in Scotland

The Commission on Scottish Devolution (also referred to as the Calman Commission), established in 2007, identified some taxes (including the Landfill Tax and the Air Passenger Duty) where devolved powers could be applied. Following this, the Scotland Act 2012 devolved powers for a Landfill Tax to the Scottish Parliament to cover landfills and transactions taking place in Scotland, which led to the Landfill Tax (Scotland) Act 2014. At the time of writing, this is the only fully devolved fiscal lever delivering reductions in GHG emissions that currently applies in Scotland.[6] Although the Scotland Act 2016 included the power to introduce a devolved tax on the carriage of passengers by air from airports in Scotland (i.e. to replace the present, UK-wide Air Passenger Duty). The Air Departure Tax (Scotland) Act 2017 was passed by the Scottish Parliament 2017, however the introduction of the tax has been deferred due to state aid (and now subsidy control) issues. The Scotland Act 2016 Act also made provisions for the creation of a devolved tax on extraction of aggregates, which is currently being legislated for in the Scottish Parliament, although this does not specifically look to reduce greenhouse gas emissions.

Indirect Taxation Schemes

The Scottish Landfill Tax (SLfT) replaced the UK Landfill Tax in Scotland from 1 April 2015 under the Landfill Tax (Scotland) Act 2012. The SLfT is part of Scotland’s Zero Waste Scheme and aims to encourage the prevention, reuse and recycling of waste in the country. It is administered by Revenue Scotland with support from the Scottish Environment Protection Agency (SEPA). SLfT is a tax on the disposal of waste to an authorised or non-authorised landfill in Scotland. The taxation of disposals to unauthorised sites (that is illegal dumping) is a key difference between SLfT and UK Landfill tax.

The Scottish Government is responsible for setting the rates of the tax as part of the annual Scottish Budget and determining which waste is subject to it. The tax is paid on the disposal or unauthorised disposal of waste to landfill and is calculated based on the weight and type of the waste material. A standard rate of £102.10 per tonne is applied, while a lower rate of £3.25 per tonne is paid on less polluting (referred to as ‘inert’)[7] materials. Tax revenues have decreased from £149 million in 2015-2016 to £125 million in 2021-2022. The SLfT has been a major part of the success in driving change in Scotland’s waste performance (Revenue Scotland, 2021).

Air Departure Tax (ADT). The Scotland Act 2016 included the power to introduce a devolved tax on the carriage of passengers by air from airports in Scotland. This allows Scotland to design a replacement for APD. The Air Departure Tax (Scotland) Act 2017 made provision for such a tax, which will be managed and collected by Revenue Scotland. However, the tax has not yet been introduced and UK APD continues to apply.

The Scottish ADT will tax flights departing from an airport in Scotland (this includes airports in the Highlands and Islands regions). As with the UK APD, the amount of tax payable depends on the destination of the passenger and the characteristics of the aircraft (take-off weight,[8] flight distance seat pitch and seating capacity). Depending on the aircraft, the passenger will pay either the standard, premium or special rate.[9] Certain flights and passengers are exempt from ADT. Exemptions apply to flights operated under a public service obligation, which may include many flights to/from small islands, although the Air Departure Tax (Scotland) Act 2017 making provision for such a tax does not mention any exemptions for passengers on flights leaving from airports in the Scottish Highlands and Islands. There are also exemptions for emergency medical service flights, military, training or research flights. Passenger exemptions apply to persons that are working during the flight, such as flight crew, cabin attendants, persons undertaking repair, maintenance, safety or security work, persons not carried for reward, such as Civil Aviation Authority flight operations inspectors, or children under the age of 16 (FCC Aviation, 2023).

ADT was originally expected to come into force on 1 April 2018. However, on April 2019 the Scottish Government deferred the introduction of ADT beyond April 2020 until issues have been resolved regarding the tax exemption for flights departing from airports in the Highlands and Islands regions. The devolution process is, thus, on hold. In the meantime, UK APD (and the rates and bands that currently exist) and the current Highlands and Islands exemption continues to apply.

Implications of the case studies for Scotland

We assessed whether the six case study examples (Section 3.7) could hypothetically be implemented by the Scottish Government under current devolved competencies. We also provide a high-level explanation of practical issues (e.g., target of the lever and groups affected). No assessment is made of the costs and benefits of adoption.

While the balance of evidence suggests that similar taxes have reduced GHG emissions where they have been applied elsewhere, the net effect on GHG emissions in the host jurisdiction is uncertain. Challenges in implementation have also been observed and there is limited detailed evidence on behavioural effects. These issues will need to be further investigated before any such tax could be considered for Scotland. If the Scottish Government were to consider exploring any of the examples we have looked at, it would be necessary to undertake thorough policy scoping, analysis and consultation, in addition to the agreement of both the UK and Scottish Parliaments. The Scottish Government could also consider these points in the context of its wider discussions with the UK Government on the direction of climate and fiscal policies as part of a collaborative approach.

Direct Carbon Tax

The UK CCL (which is in practice similar to direct carbon taxes in place in several countries or regions, including Sweden and British Columbia) could be devolved to the Scottish Parliament through an agreement between the Scottish and UK governments and parliaments on the transfer of powers.

A new Scottish carbon tax could then in theory replace the UK CCL in Scotland. This could be broadly similar to the UK CCL, although the Scottish Government could also make its own decisions on issues such as scope and rates to better align it with Scotland’s socioeconomic conditions and emissions reduction targets. Were the Scottish Government to consider such a measure, it would require significant exploration of options and detailed analysis to ensure it achieved these objectives, including consultation and engagement with stakeholders.

Emissions Trading System

The UK ETS is jointly operated by the Scottish Government, UK Government, Welsh Government and Northern Ireland Executive through the UK ETS Authority. It relies primarily on legislation that is devolved (the Climate Change Act), although parts of the ETS relating to auction processes are based on legislation that is more often considered reserved and, thus, relies on UK parliament.

A new ‘Scotland ETS’ could hypothetically replace the UK ETS. This would require prior consent of the UK Parliament, Welsh Parliament, and Northern Ireland Assembly to have effect, as well as the agreement of the Scottish Parliament. The agreement of the Scottish Parliament could be sought through new specific legislation (either primary or secondary). Thus, an Act of the Scottish Parliament to make provision about the functioning of the ETS in Scotland would be required. This could in theory cover additional sectors not covered by the UK ETS, similar to the Austrian nETS operating alongside the EU ETS. However, any such proposal would require comprehensive policy scoping and consultation, in addition to the need for agreement from each legislative body, as detailed above.

Bonus Malus Scheme for Vehicles

The UK VED (similar to the bonus malus scheme explained in Appendix D) paid by businesses and households could in theory be devolved to the Scottish Parliament. Thus the new Scotland VED would replace the UK VED through an agreement between the Scottish and UK governments and parliaments on the transfer of powers.

This could potentially allow for innovation, as differences are in principle permitted, as happened with landfill tax (the SLfT applies on the disposal of waste to both authorised and non-authorised landfills, whereas the UK landfill tax only applies to disposals to authorised sites). It could therefore be feasible to create bonuses to incentivise buyers to purchase low or zero emission vehicles (along the lines of the Bonus-Malus in France), which UK VED does not currently offer. However, this would require detailed policy scoping and consultation to ensure any potential measure operates fairly and effectively, as well as having the consent of both the UK and Scottish Parliaments.

Tax on agricultural emissions

Under Section 80B of the Scotland Act 1998 (as amended), a new tax on agricultural emissions similar to the tax on agricultural emissions proposed in New Zealand (for further details, see Appendix D) could in theory be created in Scotland as the UK Parliament can, with the consent of the Scottish Parliament, devolve powers for new national devolved taxes to be created in Scotland.