Funding and financing heat networks in Scotland

Research completed March 2025

DOI: http://dx.doi.org/10.7488/era/5740

Executive summary

Background

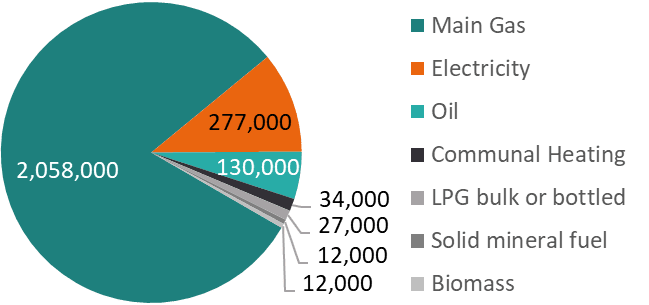

Over 72% of buildings in Scotland still rely on mains gas as their primary heat source. Scotland must further decarbonise heating in homes and buildings to achieve its climate change targets. The Scottish Government’s 2021 Heat in Buildings Strategy identified clean heat networks as a strategic decarbonisation technology. However, given the significant levels of capital investment required to transform Scotland’s buildings and limited public sector budgets, additional investment will be needed from the private sector.

Aims

This study examines present and potential future financing models in the heat network sector (“the sector”) and identifies suitable levers and actions for incentivising private finance. Findings are based on a series of interviews with stakeholders, including operators, funders, advisors and public sector representatives, as well as desk-based research. We draw comparisons and insights from other relevant utility sectors and from other countries (the Netherlands, Germany, Finland, Sweden and Estonia) as well as England and Wales.

Findings

Challenges facing the sector

In Scotland and across the UK, the heat network sector has typically been funded by early-stage financing from developers and significant levels of subsidy from the public sector. These public subsidies have encouraged private investment in the sector and supported the roll out of heat networks across Scotland.

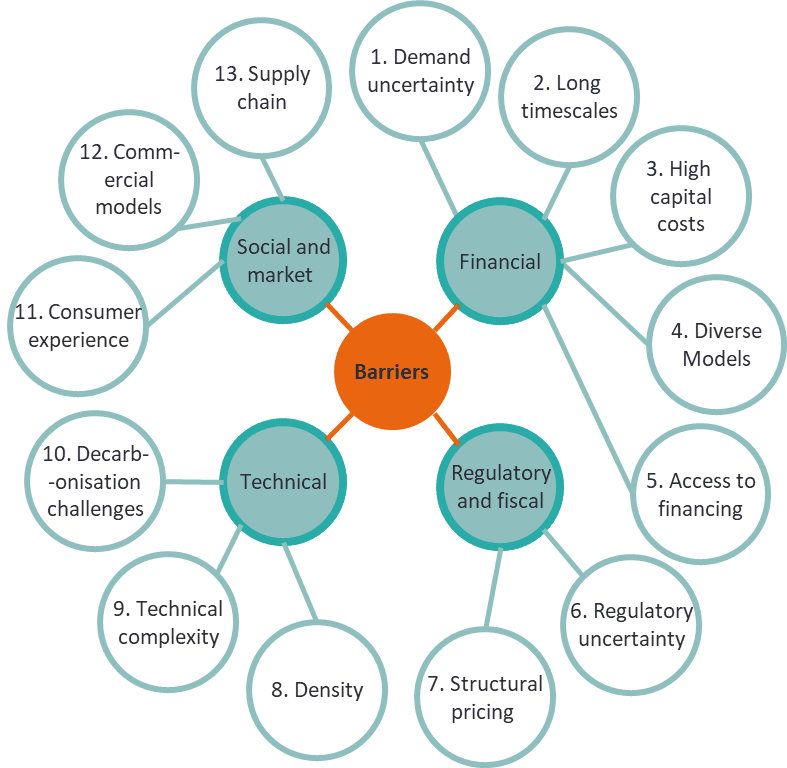

The most impactful barriers in the sector are demand uncertainty, revenue instability and the evolving regulatory environment. This limits investment appetite, restricting the roll out of heat networks at scale in Scotland. The barriers are illustrated in Figure 1.

International comparisons

- Maturity – Scotland, the rest of the UK and the Netherlands have a developing heat network sector. Germany is expanding its market. Sweden, Finland and Estonia have mature markets where the sector is tried, tested and trusted.

- Regulation – Many of the developed and mature markets are unregulated: they use self-governing frameworks and technical codes. This is coupled with high levels of local governance, greater pricing transparency and consistent contractual delivery and routes. These markets can focus on consumer pricing that supports investment and stimulates the sector’s development. Additionally, mandatory connections are being used in some circumstances in other countries, to make projects more investible and create demand assurance, which encourages private investment.

- Ownership profiles and private finance – The more developed markets (including Sweden, Finland and Estonia) have a mixed degree of public ownership. More mature markets are likely to have a higher level of private finance penetration. In Finland, public sector ownership remains at a high level, whilst still seeking investment from the private sector. In Germany there’s a growing commitment to re-municipalise infrastructure and reverse privatisations. In the Netherlands, where over 90% of sector finance is private, the government proposed legislation to part-nationalise the sector in 2022 to mitigate concerns around the affordability and reliability of the sector.

The developed markets are mainly regulated by standard frameworks. These markets can access private finance due to the established nature of the sector. However, the technology has been embedded in the culture of these countries for much longer and so regulators can focus on price transparency and fairness for the end user rather than a framework for developing the market.

- Financial levers – Most of the comparator countries have adopted a range of financial levers. Many have applied a similar approach to Scotland, including the continued use of capital grant funding, project development funding or individual grants for expanding and upgrading heat networks. Grant funding is still widely used in the less mature sectors. As the sector matures, intervention rates reduce or there is greater requirement for a higher degree of renewable heat sources to be used. Additionally, state-owned infrastructure banks have been investing in the sector to help refurbishments or provide debt financing for expansion.

Utility sectors

Various regulatory regimes and financial support mechanisms have been used in other sectors to stimulate private sector investment in the development of new infrastructure. The Scottish Government must consider the costs and practical challenges of pursuing financial support mechanism models that are not being adopted in England and Wales:

- Contracts for Difference (CfDs) have proved very successful in securing the necessary investment in a wide range of renewable energy technologies. This approach could provide revenue support to heat networks to incentivise the transition to more sustainable forms of heat generation. In particular, CfDs could support heat networks that use decarbonised heat sources (e.g. heat pumps), which are likely to have a higher cost than conventional gas boilers or heat networks using waste heat. Therefore, as well as providing revenue certainty, a CfD has the potential to subsidise the increased cost of decarbonised heat for end users.

- A Regulated Asset Base (RAB) model, alongside periodic price reviews, can protect consumer prices whilst also encouraging ongoing capital investment, supporting asset maintenance and providing predictable revenue streams. The model would, however, involve significant administrative and resource cost. Prior to the sector maturing, a RAB model might not result in financially viable heat networks without additional capital or revenue support.

- The Renewable Heat Incentive (RHI) model is a well understood revenue support mechanism previously used in the energy sector. Similar to CfDs, an RHI model would subsidise the cost of heat for consumers if it was based on the amount of heat generated (as opposed to consumption of heat). It would therefore contribute to the cost of deployment, helping to address the increased cost of installing this technology and at the same time, mitigating demand risk. A cap on payments could also be introduced to avoid over-incentivisation. However, the value for money of previous schemes has been questioned.

Market feedback

The private sector views heat networks as an attractive investment opportunity but there are areas of uncertainty that must be resolved, including the need for greater clarity on the development of future regulation. To facilitate private investment, stakeholders highlighted the need for continued grant funding support to de-risk project cashflows. They also emphasised the importance of clear regulation on key topics, including heat zoning, mandatory connection policies, planning and building regulations, as well as a definitive policy direction on phasing out gas boilers.

Recommendations

We recommend that the Scottish Government:

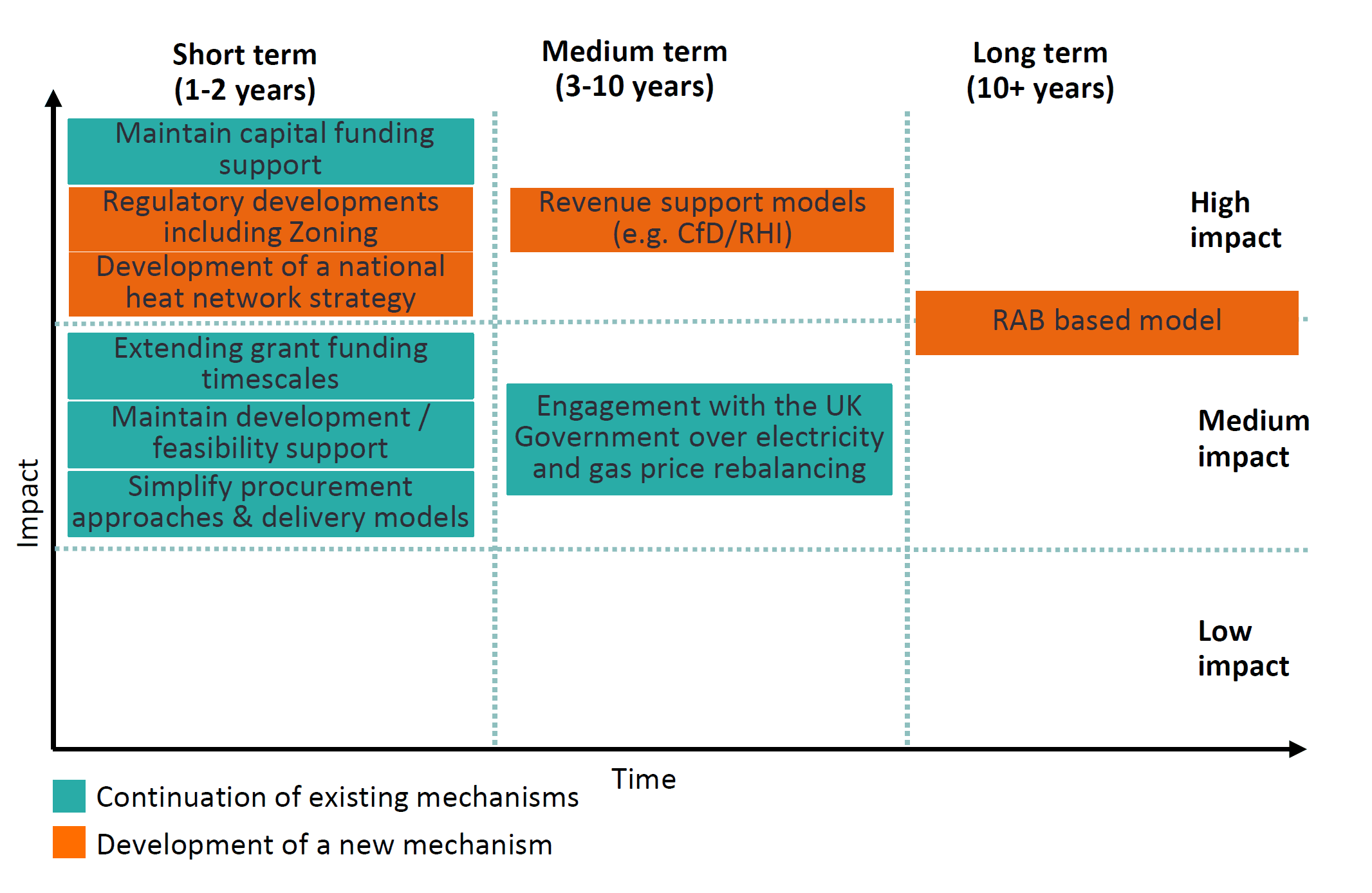

1. Maintains capital funding support for the sector, either via existing programmes, or new bespoke capital schemes. Explore opportunities for extending the timescales for drawing down grant funding.

2. De-risking future revenues is key to unlocking heat network development – private capital is available for projects, but they need to be financeable. More detailed analysis of a revenue support model, such as CfD or a RHI equivalent, is merited. However, the Scottish Government must address the challenges of establishing such schemes, including the significant administrative and resource implications of previous schemes.

3. Explores the benefits of implementing a RAB model, following further regulatory developments and the creation of an established asset base (over 10-15 years). However, consider the complexity and feasibility of this model.

4. Continues to work closely with the Scottish National Investment Bank (SNIB) and the UK National Wealth Fund to explore investment opportunities, create a shared understanding of each party’s objectives and ultimately unlock the capital that has been made available to invest. Both organisations are committed to investing into the sector.

5. Maintains and increases support for pre-construction projects, via the Heat Network Support Unit (HNSU) and specific development funding programmes.

6. Monitors the implementation of the UK Government’s zoning approach and, where appropriate, leverage best practice from the Department for Energy Security and Net Zero (DESNZ). This should be used to complement Scotland’s existing zoning approach.

7. Reviews its approach to regulation to help reduce regulatory uncertainty. Where appropriate, this should include leveraging best practice from England and Wales.

8. Continues to work with the UK Government on rebalancing electricity and gas prices. However, this will not eliminate the price difference between electricity and gas.

9. Develops a national Heat Network Strategy setting out a clear long-term vision for heat networks in Scotland.

Glossary / Abbreviations table

|

£/€ bn |

Billions of £/€ |

LCCC |

Low Carbon Contracts Company |

|

£/€ m |

Millions of £/€ |

LCITP |

Low Carbon Infrastructure Transition Programme |

|

ACM |

The Netherlands’ Authority for Consumers and Markets |

LHEES |

Local Heat and Energy Efficiency Strategies |

|

AMP |

Asset Management Plans |

MWh |

Megawatt hour |

|

ASHP |

Air source heat pumps |

NFFO |

Non-Fossil Fuel Obligation |

|

CAA |

Civil Aviation Authority |

NIB |

Nordic Investment Bank |

|

CAP |

Competitively Appointed Provider |

NWF |

National Wealth Fund |

|

CCC |

Climate Change Committee |

ODI |

Outcome delivery incentive |

|

CCUS |

Carbon Capture, Utilisation and Storage |

OFTO |

Offshore Transmission Owners |

|

CfD |

Contract for difference |

ORR |

Office of Rail and Road |

|

CXC |

ClimateXChange |

RAB |

Regulated asset base |

|

DBFO |

Design, Build, Finance and Operate |

RAV |

Regulated Asset Value |

|

DESNZ |

Department for Energy Security and Net Zero |

REMA |

Review of Electricity market arrangements |

|

DHLF |

District Heating Loan Fund |

RESCo |

Regional Energy Services Company |

|

DHN |

District heat network |

RHI |

Renewable Heat Incentive |

|

DPC |

Direct Procurement for Customers programme |

RIIO |

Revenue = Incentives + Innovation + Outputs |

|

EfW |

Energy from Waste |

ROC |

Renewable Obligation Certificates |

|

EY |

Ernst and Young LLP |

rUK |

Rest of the UK |

|

FOAK |

First of a Kind |

SFT |

Scottish Futures Trust |

|

GHNF |

Green Heat Network Fund |

SHNF |

Scotland’s Heat Network Fund |

|

HN |

Heat network |

SNIB |

Scottish National Investment Bank |

|

HNDM |

Heat networks delivery models |

SPV |

Special Purpose Vehicle |

|

HNES |

Heat Network Efficiency Scheme |

SRO |

Scottish Renewables Obligation |

|

HNIP |

Heat Networks Investment Project |

T&SCo |

Transport and storage infrastructure |

|

HNSA |

Heat Networks (Scotland) Act 2021 |

TWh |

Terawatt hours |

|

HNSU |

Heat Network Support Unit |

UK |

United Kingdom |

|

KfW |

Germany’s infrastructure bank |

WCW |

Dutch Collective Heat Supply Act |

|

KPI |

Key Performance Indicators |

WPG |

Germany’s Local Heat Planning Act |

Introduction

Research aims

This report examines the heat network sector (also referred to as “the sector”) and will contribute to the Scottish Government’s ambition to accelerate the pace and scale of heat network rollout in Scotland. The report:

- Summarises current financing models, structures, and barriers in the sector and establishes a baseline for the Scottish heat network landscape

- Draws comparisons and insights from relevant utility sectors

- Draws comparisons with international heat networks and their financing models

- Provides insight into how heat networks are currently viewed by the private and public sector

- Recommends suitable financial levers, models and policies for the sector

“Heat Network” definition

The definition of a “heat network” in the Heat Networks (Scotland) Act 2021 (HNSA) covers both district heat networks and communal heat networks. A district heat network distributes heat from one or more sources to more than one building. In a communal heating system heat is supplied to one building comprised of more than one building unit (for example, a block of flats).[1]

The majority of the findings in this report refer to district heat networks, but we have included both communal heating and district heating in our definition of a heat network.

Heat networks can be powered by a range of different technologies. Historically, heat networks have often utilised fossil fuels, including gas boilers. As a result, many legacy networks still rely on fossil fuel-based technology. Our analysis considers these legacy networks; however, we recognise that the Scottish Government is committed to supporting the roll out of clean heat networks and supporting the reduction in emissions from the sector. This is important context for the conclusions in this report.

Methodology

Our findings are based on extensive desk-based research conducted by sector specialists. The analysis also draws on insights from a series of interviews with sector stakeholders, including operators, funders, advisors and public sector representatives. This information has been used, together with our own sector experience and evidence from existing literature, to set out the existing baseline position in Scotland (and the rest of the UK) and to develop our recommendations for suitable financial levers, models and structures for the heat network sector in Scotland. Finally, the stakeholder feedback also informed our approach for drawing comparisons with other utility sectors and international comparators.

Our stakeholder engagement methodology and questions were agreed with CXC and the Scottish Government Steering Group. The engagement exercise consisted of 20 meetings and Microsoft Teams calls. In advance of the sessions, participants were issued with the questions and given the opportunity to share feedback either in writing or verbally.

Policy Context

Scotland’s ambitious climate change targets are to achieve net zero greenhouse gas emissions by 2045. To deliver this, Scotland must instigate a step change in decarbonising the heating of its homes and buildings. Domestic buildings account for 15% of Scotland’s total greenhouse gas emissions and around 27% of its total energy consumption[2]. The scale of this decarbonisation challenge is significant – Figure 2 shows that in 2022, over 72% of Scotland’s homes relied on mains gas as their primary heating fuel[3].

Figure 2: Breakdown of primary heating fuel vs number of homes

The Scottish Government’s 2021 Heat in Building Strategy identified clean heat networks as a key strategic technology which is tried and tested and can be scaled up.

The Heat Networks (Scotland) Act 2021 established statutory targets for heat supplied by heat networks, requiring that they supply 2.6 Terawatt hours (TWh) of output by 2027, 6 TWh by 2030 and 7 TWh by 2035. In 2022, the Scottish Government estimated that heat networks supplied 1.35TWh of output[4]. To meet Scotland’s ambitious statutory targets, a significant acceleration in deployment is necessary.

Source: Scottish House Condition Survey 2022

The public sector plays an active role in the sector’s development, both at the national and local level. Local Heat and Energy Efficiency Strategies (LHEES) are local authority-led plans to decarbonise heat and improve energy efficiency, including rolling out heat networks in suitable locations. Momentum is building, with Scottish local authorities publishing their LHEES strategies, which include establishing the role of heat networks as a key decarbonisation measure.

The capital investment required to transform Scotland’s buildings (between now and 2045) is expected to be in the region of £33bn[5]. Given the size of this investment and the limited nature of public sector budgets, significant levels of finance will need to come from the private sector.

Current financing structures and models in Scotland’s heat networks

Scotland’s heat network sector

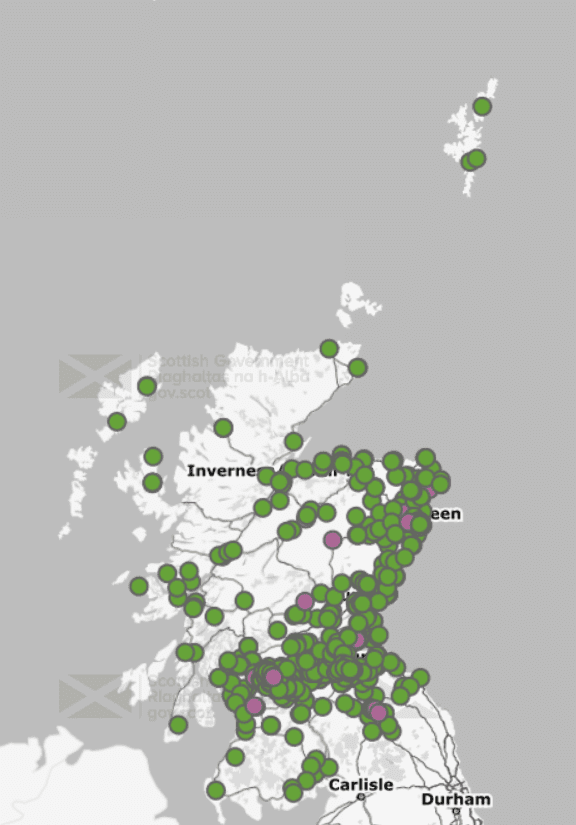

Heat networks distribute heat from a central source, avoiding the need for individual heating systems (such as gas boilers). There are over 1,090 known heat networks (the majority being communal heat networks) supplying heating and cooling to domestic and non-domestic properties[6]; however, most of the larger networks with significant heat loads are in Scotland’s larger towns and cities. Although recent projects have introduced clean heat sources, the sector still relies on mains gas as its primary heat source[7].

Figure 3: Heat networks in Scotland

The number of heat networks, both district and communal, is increasing across Scotland. Figure 3 illustrates the distribution of heat networks in Scotland, but the sector is still immature, especially compared to counterparts in Europe, where heat networks have played a central role in heat infrastructure since the 1940s.

Sector growth has been slow, and in recent years, the focus has been on a series of “demonstrator” projects, across a range of sizes and driven by early adopters in both the private and public sectors.

Source: Map – Heat Network Support Unit

Scottish and UK regulatory landscape

There is an emerging focus on the regulation of heat networks within Scotland and the rest of the UK. For the first time in the UK the sector is set to become regulated, like many other utility sectors. Given the decarbonisation requirement and recognising the growing importance and potential of heat networks, the Heat Networks (Scotland) Act 2021 (HNSA) created a regulatory framework for the sector in Scotland.

The regulation of consumer protection (including for heat networks) is reserved to the UK Government. In 2024, the UK Government and Ofgem jointly consulted on regulations to establish an authorisation system to protect heat network consumers under the Energy Act 2023. Ofgem will be the future regulator of that consumer protection regime across England, Scotland and Wales. Ofgem’s will also be responsible for heat network licences and authorisations in Scotland, as set out in the HNSA.

The HNSA includes a series of measures to support the sector and promote growth. These are summarised in table 1 below, alongside the relevant UK position. The UK Government has proposed a regulatory regime but has yet to introduce secondary legislation. For those measures not in force in Scotland, these will also be introduced by the secondary legislation.

Table 1: Scottish and UK regulatory landscape

|

Scottish landscape[8] |

England & Wales landscape |

|---|---|

Zoning, permitting and licensing

| Zoning, permitting and licensing |

Consumer protection | |

Technical standards | |

The HNSA and the new UK Energy Act both aim to introduce legislation that has the potential to align the regulatory landscape across the UK. However, our stakeholder engagement process found that significant regulatory uncertainty currently exists, including the diverging timetable for introducing legislation and the lack of clarity regarding the differences in proposals between Scotland, England and Wales. Without further developments on specific regulatory areas, such as permitting/zoning, this uncertainty will remain. We also acknowledge that there is a complex regulatory landscape, with input required from both the Scottish and UK Governments to clarify the balance between devolved and reserved powers. These observations are further developed in section 4.4.

The HNSA has created an opportunity for Scotland to benefit from a robust regulatory framework that builds trust for consumers and creates certainty for operators. In order to stimulate sector growth, the market requires further clarity on the ongoing process to regulate the sector and more detailed information regarding the introduction of secondary legislation. This should provide clarity regarding investment opportunities, reduce the complexity of the dual regulatory frameworks and make Scotland a more attractive investment proposition.

The sector is also impacted by other Scottish regulation, including the New Build Heat Standard, which requires new homes and buildings to install clean heating systems, rather than relying on mains gas. Additionally, the National Planning Framework 4 includes policies which states that development proposals (within or adjacent to a heat network zone) will only be supported if they connect to an existing heat network.

Existing financing models in the sector

In Scotland and across the UK, the sector has typically been funded by early-stage financing from developers and significant levels of subsidy from the public sector. The Scottish Government has supported clean heat networks through:

- Grant support (also in the form of repayable assistance), including:

- Scotland’s Heat Network Fund (SHNF) – The SHNF offers capital grant funding to support the roll out of new clean heat networks and communal heating systems, as well as the expansion and decarbonisation of existing heat networks across Scotland.

- Low Carbon Infrastructure Transition Programme (LCITP) – From 2015 until it was replaced by the SHNF in 2022, LCITP provided grant funding support to several heat networks, including Queens Quay and Torry heat network.

- Both programmes also provided project development and commercialisation support.

- Loans via the District Heating Loan Fund (DHLF) – Managed by the Energy Savings Trust, the fund provided capital loan funding to support low emission small scale district heating in Scotland until it closed in April 2024.

- Non-domestic rates reliefs – since April 2024 heat networks (where 80% of the thermal energy in any given year is generated from renewable sources) have been eligible for a 90% rates relief.[9] There is also a 50% rates relief if a premises is wholly or mainly being used for a district heating network.[10]

- Many demonstrator projects also benefitted from historical UK Government revenue support through the Renewable Heat Incentive (RHI), now closed to new applicants.

These public subsidies have encouraged private investment in the sector and supported the roll out of clean heat networks across Scotland. Many clean heat demonstrator projects have been self-funded by operators (or funded through bespoke delivery vehicles). However, grant funding is required to bridge funding gaps and enable projects to achieve the internal rate of return – often referred to as a hurdle rate – required by operators. This is more important for clean heat networks than for fossil fuel-based systems, where the requirement for public subsidy is less pressing given the lower capital costs.

The hurdle rate is different for each operator and project. It is impacted by an operator’s cost of capital and project specific risks, but our analysis indicates that, at the time of this report, it tends to range between 8% and 12% (although this range will be impacted by several external factors and will vary on a project-by-project basis). This is explored further in section 0.

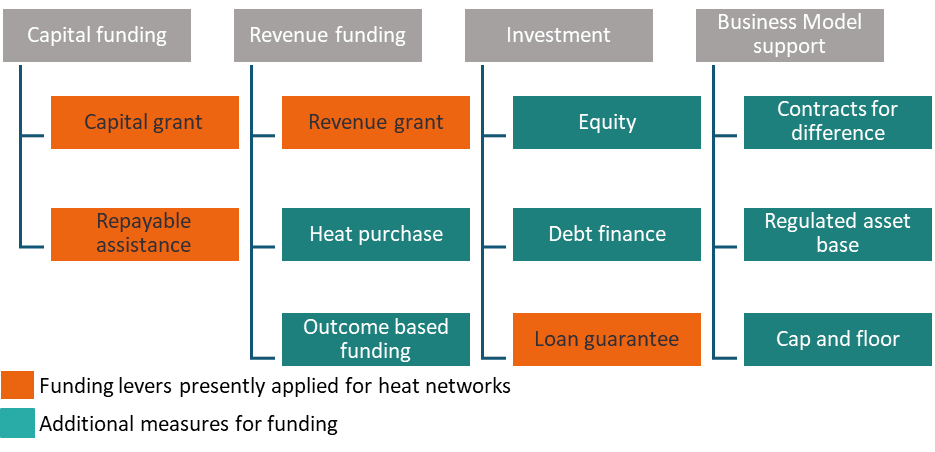

Grant support is among several financial mechanisms (or “financial levers”) which the Scottish Government has historically used. Such support could continue to de-risk heat network projects and help incentivise private sector investment. Figure 4 highlights some of the key mechanisms used to date and others which are considered further in this report. A summary of each mechanism can be found in Appendix B.

Figure 4: Funding levers the Scottish Government could deploy to attract private investment

In order to understand how a step change in private investment might be instigated, it is important to highlight the key factors which drive investor confidence, namely:

- Certainty of demand

- Revenue stability

- A stable regulatory environment

- A clear understanding of project risks with shared ownership and mitigation strategies

These factors and wider deployment barriers are explored in the following section.

Heat network deployment barriers

Overview

The analysis contained in this section includes feedback from our stakeholder interview exercise, as well as our own professional observations. While many of these barriers are well understood in the market, key stakeholders confirmed that they continue to present significant live obstacles for private sector operators and investors, limiting their investment appetite and restricting the roll out of heat networks at scale in Scotland. Following stakeholder feedback, we have grouped these barriers (shown in figure 5) into four categories:

- Financial

- Regulatory and policy

- Technical

- Social and market barriers

Figure 5: Heat network deployment barriers

Within these categories, we present the barriers in order of importance (based on the strength of stakeholder feedback). It is important to note that whilst our report is primarily focussed on financial barriers and the private sector, many of these non-financial barriers add further uncertainty and therefore need to be taken into consideration. All these barriers – financial and non-financial – must be addressed in order to instigate a step change in private investment.

Financial barriers

Heat networks involve significant levels of financial risk and uncertainty, making it extremely challenging to forecast a project’s cashflows, thereby deterring private investment. These financial risks are highlighted below:

Demand uncertainty

Demand uncertainty is the biggest factor inhibiting private sector investment. For a heat network to be financially and commercially viable, it should generate a minimum level of committed revenue in order to meet the operating costs of the network and contribute to the repayment of the initial capital investment. This can be challenging if it is unclear when and how many buildings will connect to the network, their heat offtake requirements and the resulting revenue that will be generated.

For many Scottish “demonstrator” projects, demand and revenue risk have been reduced by securing anchor loads via public sector buildings, which require large heat offtake requirements and therefore to provide some revenue certainty. Developers and investors prioritise the de-risking of revenue flows as it provides greater certainty in a project’s ability to service the repayment of any debt or shareholder loans and/or equity return. As a result, securing longer term supply agreements with customers is a critical step in securing additional investment.

Operators stated that investment decisions are not speculative – the extent of committed revenue and certainty of connections are critical considerations to a potential developer and/or investor. To date, projects have typically been funded using balance sheet finance of the project sponsors (corporate finance) in the form of shareholder loans and equity, rather than more conventional third-party debt finance in the form of limited or non-recourse debt finance. When a heat network project reaches critical mass with mature connections and revenues, this provides an opportunity to refinance and secure more competitive finance terms due to reduced lending risk.

Long development and construction times

Many heat network projects have significant development and construction timescales, which present barriers to funders. In some cases, projects can take two or more years to develop and several more years to construct. This results in significant development and commercialisation costs, requiring high levels of upfront finance.

Historically, as a means of mitigating these development costs, the public sector offered support through the Heat Network Support Unit (HNSU) and specific grant funding programmes. However, stakeholders identified a misalignment between the grant funding drawdown profile (the existing grant funding programmes have shorter funding windows, typically four years) and the long construction cost profile (upwards of 5-7 years). This means that operators have had to condense the delivery programmes to meet the grant drawdown deadline or seek additional sources of financing.

High capital costs

Heat networks require significant levels of capital investment. Several recent Scottish heat network projects have had capital cost estimates of between £10m and £50m[11]. This barrier is exacerbated in times of high inflation and cost uncertainty. The high levels of capital investment are commensurate with other utilities such as water, gas and electricity. All require significant investment in underlying infrastructure prior to connection with residential, commercial and public sector buildings.

Large capital projects are often regarded as higher risk and therefore more challenging to finance. Due to cash flow uncertainties, this sector has historically relied on significant levels of grant funding. Public support (including Scottish Government programmes such as LCITP and SHNF) has been essential for improving private sector returns and sharing the risk of the high capital costs. When this support is unavailable, operators mitigate this risk in other ways, for example, by seeking increased connection fees for end users.

Diverse delivery models and procurement approaches

The lack of standardisation in procurement approaches and delivery models adds complexity, time and cost to a project’s development timeline. Projects develop bespoke approaches that are not necessarily repeatable for new projects. This inhibits the market’s ability to understand the investment landscape and reduces confidence. Investors are far more likely to pursue projects where there are standard procurement approaches and tried and tested delivery models, where the risks are understood.

The availability and access to financing

Debt lenders have been reluctant to invest in the sector due to the risks noted above. Current stakeholder feedback confirms that this remains the case. Typically, large infrastructure projects would look to include both equity and debt to optimise financing costs and spread the risk on investment. However, heat network projects typically struggle to demonstrate that they will have sufficient free cashflows to service the cost of debt. As such, debt lenders will seek to invest their funds in alternative sectors where they have more confidence in the cashflows. If these other sources of financing cannot be brought into the sector, the ability to roll out new projects at scale will be limited.

Regulatory and fiscal challenges

Although the financial barriers are significant, they must be considered alongside regulatory and fiscal challenges. These have created uncertainty in the market and have negatively impacted the private sector’s investment appetite. Stakeholder feedback highlighted the importance of these areas in unlocking Scotland’s heat network ambitions. However, as we discuss below, the Scottish Government does not have the ability to resolve all these issues.

Regulatory uncertainty

The Heat Networks (Scotland) Act in 2021 introduced powers to regulate the Scottish heat networks market for the first time. The Energy Act 2023 was passed by the UK Parliament in October 2023. Differences in implementation, content and timing of regulation between Scotland and the rest of the UK are negatively impacting investor sentiment and creating uncertainty. Developers and funders are also looking for clarity on the future GB-wide consumer protections and technical and service specifications for operators.

Without further clarity on the future secondary legislation in Scotland, operators stated they are more likely to focus resources outside Scotland – for example, in other UK areas – where there is more demand for larger urban heat network opportunities.

This uncertainty also extends to other relevant policy areas, such as the phasing out of domestic gas boilers, which presents barriers to operators. The Scottish Government has introduced the New Build Heat Standard, which states that by 2045, all homes in Scotland will need to have converted to a clean heating system. Across the rest of the UK, there is political uncertainty about this phase out. No equivalent legislation is currently in place, meaning heat networks operators are unclear when customers will be required to adopt low emission heating solutions.

Structural pricing considerations

Reducing the gap between the price of electricity and the price of gas may help support the rollout of low carbon heat networks. Under the current domestic[12] electricity pricing model, electrified low carbon heating solutions are unlikely to offer cost savings to consumers when compared against traditional gas boilers.

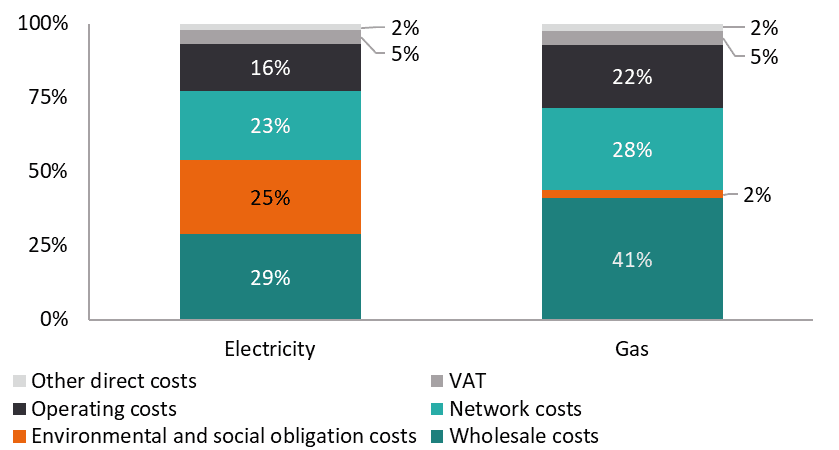

Historically, electricity has been more expensive than gas, partly due to the greater proportion of environmental and social obligation costs (green levies) placed on electricity (23%) compared to gas (2%), as shown by the figure 6 below.

Figure 6: Breakdown of domestic electricity and gas bill

The UK Government is currently consulting on the “Review of Electricity market arrangements” (REMA), which includes proposals for reducing electricity costs for consumers. Removing these levies from existing energy tariff structures would reduce the running costs of electrified heating solutions and encourage the uptake of low carbon heating.[13] However, there are many complexities involved in this change and the impact of rebalancing these costs must be understood further before it can be proven to be an effective mechanism for reducing electricity costs.

In addition to the impact of the levies, electricity prices (and gas prices) also include significant distribution and transmission charges (network costs). Electricity bills could be reduced by permitting heat networks connected to the electricity grid to pay lower network charges (recognising their ability to use electricity at times of low demand).

Regardless of these potential mechanisms, relatively low gas prices will continue to disincentivise the rollout of low emission heat networks, as they make any change to an alternative heat source appear more expensive. This is proving to be a significant barrier in the private sector.

Technical challenges

Operators and funders pointed to several heat network-related technical barriers which create further uncertainty and investor reluctance. The high-level technical challenges noted below are not an exhaustive list but rather provide important context for the rest of this report.

The need for density

In high density urban areas where there are large levels of heat demand, heat networks often provide the lowest cost low carbon heating option. The alternative is for properties to use individual air source heat pumps (ASHPs), which would place greater electricity demands on the grid and may result in higher customer costs and increased operational costs. Scotland has several areas where there is significant scale and suitable density levels for heat networks. However, operators noted that there are a greater number of large urban areas with multiple opportunities in England. This naturally provides significant competition for investment that might otherwise be made in the Scottish locations, especially for operators (operating both in England and Scotland) exploring opportunities across the UK. Additionally, smaller scale communal heating solutions may be appropriate for lower density areas; however, we do not explore this in detail as it is outside the scope of the report.

Technical complexity

Many of the existing heat network projects utilise different heat sources and technological solutions, including things as basic as pipework sizing. As projects increase in size, this lack of standardisation can present challenges for heat networks integrating and/or scaling up.

Decarbonisation challenges

Historically, many heat networks across the UK (and internationally) have been powered by carbon-based heat sources. However, operators consistently noted that customers now expect heat networks to use low emission heat sources. Low carbon technology is typically more expensive, and technologically complex than legacy carbon-based fuel sources and this therefore represents an additional factor impacting the commerciality of new projects.

Social and market challenges

The sector also experiences wider challenges in the development of the market for heat networks.

Consumer experience and scepticism

Operators and funders highlighted recurring customer concerns, including security of supply, pricing and consumer protection, that provide challenges to operators attracting potential domestic consumers to their heat networks.[14] Additionally, countries with a long history of operating heat networks, have an established culture of valuing and trusting the technology meaning consumers better understand the benefits. These factors have supported the development of international heat networks and have resulted in reduced levels of negative consumer experience and scepticism.

Lack of standardised commercial models

The lack of a standard delivery and operating model for heat networks results in developers and public sector partners (e.g. local authorities) having to invest significant time and resources developing proposals for their projects. This is explained further in section 4.5. This additional time and complexity increase development timescales.

Supply chain – the sector has a limited number of heat network developers

There are a limited number of private sector operators in Scotland, which in turn have a limited supply chain. The current developer landscape includes a number of balance sheet backed developers (SSE, EON, Vattenfall) and some infrastructure fund backed developers (Hemiko, 1Energy and Bring Energy).

This places a high dependency on a very small number of corporates relative to the scale of the heat network opportunities in the wider UK. Additionally, local authorities have a significant role to play in developing networks but they have limited in-house capacity and resource and therefore, rely on a small number of financial, technical and legal advisors.

Heat network delivery models – summary/overview

To address some of the barriers restricting the roll out of heat networks at scale, the Scottish Government is exploring a range of levers, including financial, technical and regulatory, and considering the optimum delivery models to support the sector. Although this report does not undertake a detailed assessment of these models, our overview provides context for the financial levers explored further in this report.

In 2022, the Scottish Government commissioned the Scottish Futures Trust (SFT) to undertake analysis on potential delivery models that could accelerate the pace and scale of heat network deployment in Scotland. The subsequent Heat Networks Delivery Models (HNDM) report, published in February 2024, identified four models that warranted further detailed development and consideration, namely:

- Regional Heat Partnership / Regional Energy Services Company (RESCo) model

- Local authority-led joint venture

- Local authority-led delivery, with Scottish Government stake

- Centrally-led delivery

Following the HNDM report’s publication, Scottish Government has collaborated with SFT to further develop the Regional Heat Partnership and Centrally-led models.

Overview of international experience

The Scottish Government can draw insight from comparable European and other international markets. It can be particularly helpful to consider how these sectors are developed, financed and regulated. To develop this insight, we have reviewed approaches in countries with high levels of market maturity, as well as those with characteristics similar to Scotland’s.

Our analysis is primarily based on five international examples, referred to in this section as the “comparator countries”. As shown in Figure 7, these are the Netherlands, Germany, Finland, Sweden and Estonia. During our shortlisting process, we considered jurisdictions such as the USA, Canada, Belgium, Ireland, Latvia and Poland, but found a lack of relevant data from which meaningful conclusions could be drawn. Our analysis will refer to these other countries where relevant.

Source: EY Analysis

Denmark has a mature and successful heat network sector and is often considered a valuable source of insight for Scotland. It is deliberately excluded from our analysis as the Scottish Government has a detailed understanding of the factors that have contributed to its success. These factors include cultural acceptance of heat networks and high consumer trust. Additionally, it has established regulatory levers such as mandatory connections.

This section provides an overview of:

- The history of comparator countries’ heat networks with a brief market overview

- The availability and impact of public financing levers

- The regulatory structures

- The market ownership profile and level of private finance penetration

- The financial composition of heat network assets

0B provides supplementary information for each international example.

History of international heat networks and market overview

Figure 8 summarises the maturity of each country’s heat network sector, based on the definitions developed by Department for Energy Security and Net Zero (DESNZ)[15]:

- Emerging – the market is still a nascent sector with lots of growth opportunity

- Expanding – the sector is established but is continually growing

- Consolidating – the market is mature and technology is being refined, updated or refreshed

- Refurbishing – the market is very mature and heat network technology is on the nth generation, but the networks are aged and require significant replacement and/or refurbishment

The comparator countries have a range of heat network maturity levels, with Finland and Sweden widely acknowledged as having mature and well-established sectors, while the Netherlands has an emerging heat network sector with many similar characteristics as Scotland.

DESNZ classified the UK and therefore by implication, both Scotland and the rest of the UK as emerging markets. 0B provides a brief historical overview of each international comparator.

Figure 8: Maturity of international heat networks

|

Emerging |

Expanding |

Consolidating |

Refurbishing |

|

Scotland |

Germany |

Sweden |

Estonia |

|

rUK |

Finland | ||

|

Netherlands |

Source: DESNZ (BEIS) “International review of heat network frameworks” (2020)

Key findings

The Nordic countries (Sweden and Finland) and Estonia are in the “consolidating” and “refurbishing” categories. In each country, the sectors are mature and the technology is tried, tested and trusted.

Overall, the Nordics have been leaders in district heat networks since the 1940s. The 1970s oil crisis stimulated a transition to alternative fuel sources and acted as a catalyst for rapid expansion in the sector. This early adoption is a significant factor driving the higher degrees of maturity in their district heating networks. Familiarity of the technology has supported the cultural acceptance. By 2015, 46% of Sweden’s heat networks were supplied by biomass and only 7% utilised oil or gas[16].

Heat networks are common in Germany, with the first pilot system having gone live in the 1950s. The sector has grown over the last decade with significant numbers of large-scale heat networks. Therefore, the market has surpassed the initial emerging phase of high growth but strives to continually expand toward becoming a mature market.

Germany is in the expanding category. Compared to Scotland, Germany has been using heat networks for much longer and the initial rapid growth phase has taken place. There is now a focus on continuing to add connections to existing networks.

Although the Netherlands implemented its first heat networks in a comparable time frame to Germany (Utrecht in 1923, followed by Rotterdam in 1949) this early adoption was not built upon, and no new networks were constructed in the 1950s and 1960s. However, there has been a moderate uptake of district heating schemes since the late 1980s.[17] The market is therefore relatively small but undergoing rapid change driven by a political commitment to decarbonise heat and reduce emissions from buildings. Therefore, there are strong similarities between Scotland and the Netherlands both in heat network market size and nascency and the Government’s ambition to decarbonise heat in buildings using district heating.

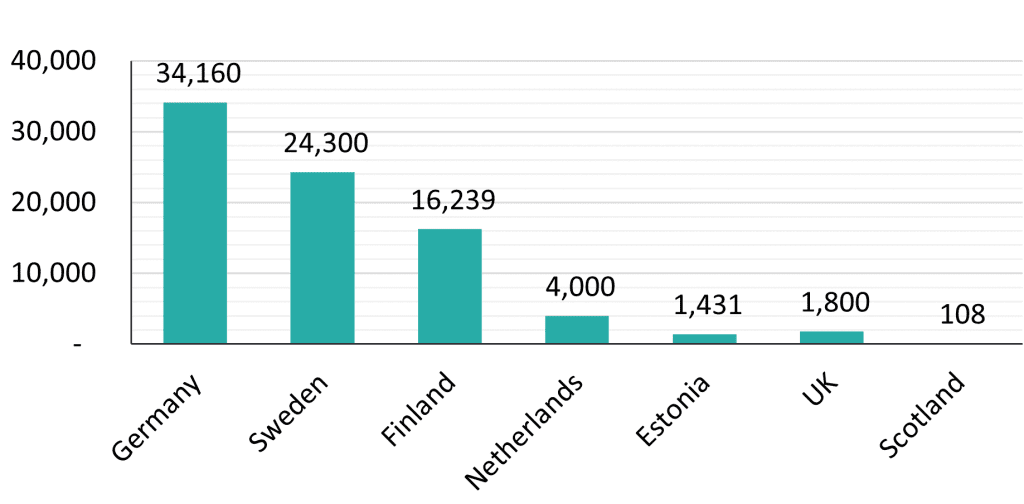

The scale of heat networks in most of the comparator countries differs significantly from Scotland. Figure 9 illustrates the cumulative length of heat networks in kilometres in each country[17]. While country size plays a role, Germany has nearly 35,000km of heat network infrastructure, whilst Estonia, although highly developed, is limited by its comparatively smaller size. Notwithstanding that, Scotland’s relative position to the comparator countries is clear.

Figure 9: Cumulative kilometres of heat networks

Source: EY analysis

Across Europe, the maturity of the sector varies, with countries such as Sweden, Finland and Estonia building on the successful implementation of decades worth of investment in the sector. The sector is still emerging in Scotland, like the Netherlands, where it does not demonstrate many of the characteristics of the more mature countries, such as cultural acceptance of heat networks and scale in the market. This provides important context for the following section reflecting on the appropriateness and availability of financial levers.

Impact of public financing levers

Public financing levers significantly influence the implementation and expansion of heat networks internationally. Financial levers serve as catalysts for innovation, growth and the adoption of low carbon technologies.

Table 2 provides an overview of the financial mechanisms that aid the development and expansion of heat networks. The levers include capital grants, tax exemptions and incentives, revenue grants, individual connection grants and decarbonisation incentives (for example, grant funding for decarbonised technology). Each country is discussed further in Appendix B.

Table 2: Summary of public financial levers used by international comparators

|

Country |

Financial Levers |

|

Rest of the UK |

|

|

The Netherlands |

|

|

Germany |

|

|

Finland |

|

|

Sweden |

|

|

Estonia |

|

Source: EY Analysis

In addition to the financial levers shown above, most comparator countries also benefit from a state-owned infrastructure bank investing in their district heating sector. State-owned infrastructure banks operate on similar terms to commercial lenders but may have the ability to adopt an increased risk appetite. This enables them to support heat networks in circumstances where commercial banks cannot. Additionally, EU member states benefit from access to EU funding where there are no bespoke heat network funding pots.

Recent investments reflect a growing appetite to engage across different markets with varying levels of maturity. For example, banks like the Nordic Investment Bank (NIB) provide investment support to help refurbish existing heat network assets across the Nordics and Baltics, while Germany’s infrastructure bank (KfW) is providing grants to help continue the transition to a more mature market in Germany.

Stakeholder engagement confirmed that both Scottish National Investment Bank (SNIB) and National Wealth Fund (NWF) have ample capital to deploy. The issue was reported to be a lack of investible projects.

0 provides a summary of state-owned infrastructure banks and relevant examples across the chosen countries.

Key findings

As illustrated by Error! Reference source not found., most of the comparator countries have adopted a range of financial levers. Many have applied a similar approach to Scotland, including the continued use of capital grant funding, project development funding or individual grants for expanding and upgrading heat networks.

Grant funding is a common financing lever, especially for the countries who are growing their heat network sectors. For example, in 2022 Germany introduced a €3bn fund to support the development and construction costs of new decarbonised heat networks (where 75% of the heat is sourced from decarbonised heat sources)[18]. This provides grant funding up to 40% of the eligible capital costs. The fund also provides feasibility support to projects. Additionally, the Netherlands is using a €400m fund to support the capital costs of new heat networks. The analysis shows that capital grant funding continues to be popular as an effective funding lever available before the sector reaches maturity. Regarding the UK market, there is continued funding from the Green Heat Network Fund (GHNF), with £288m initially made available and an additional £485m allocated in December 2023. The GHNF is expected to run until 2028, however operators expect that this will continue past 2028.

Another common lever in more mature countries is using individual grants or connection grants to incentivise connection to heat networks. For example, KfW helps deliver anchor loads to networks by offering increased grant support to local authorities for the connection of public sector buildings. Examples of individual incentives include the Estonian Business and Innovation Agency grant, which offers up to €10,000 for small residential buildings to connect to existing networks.

Estonia also offers a phased compensation scheme for the use of heat networks versus existing carbon-based alternatives. The Estonian Government provided compensation of 80% of the additional costs faced by heat network users because of increased energy prices.

Finland is developing a tax credit scheme which projects will be able to benefit from after they become operationally profitable. This has the aim of making project cashflows more appealing to investors, helping increase early returns by reducing the tax expense.

It is clear that many countries are promoting the use of grant funding to varying degrees. Significant levels of support are provided in jurisdictions with less mature sectors, while more mature countries use and develop other forms of support. The use of grant funding in Scotland and the rest of the UK is well established. Similarly, the Netherlands with its less mature sector also provides significant grant funding programmes. In Germany (an expanding country), grant funding continues to be a well utilised financial lever but intervention rates have decreased from predecessor programmes. Additionally, there is a requirement for a much larger proportion of the heat to be from renewable sources. The example of other emerging countries in Europe indicates that the market in Scotland will continue to rely on grant funding, even if the intervention levels decrease (like Germany) or grant funding is targeted at specific areas of sectors.

Regulatory structures

Our international comparator countries employ a range of regulatory structures (regarding operation, pricing and decarbonisation requirements) and national oversight. These range from self-governing municipality frameworks with a limited role for national regulators to nationwide regulatory frameworks governing the entire heat networks market. Whilst regulatory landscapes differ, the varying regimes offer interesting lessons for heat networks in Scotland.

Table 3 provides an overview of the international regulatory landscape and each country’s approach to mandatory connections. Detailed findings for these countries are shown in 0.

Table 3: Overview of international regulatory landscape

|

Country |

Regulated/Unregulated |

Mandatory Connections |

UK |

Regulation in development |

No* |

|

The Netherlands |

Regulated |

Yes |

|

Germany |

Unregulated |

No |

|

Finland |

Unregulated |

No |

|

Sweden |

Regulated |

No |

|

Estonia |

Regulated |

Yes |

*DESNZ is currently shaping its policy approach to mandatory connections. It is expected mandatory connections will be enforced on certain buildings in defined zones to be connected to heat networks by a given deadline[19]. However, details are yet to be fully confirmed.

Key Findings

Across our comparator countries, many of the developed and mature markets (e.g. Finland and Germany) are unregulated. The heat networks have a self-governing framework and abide by technical codes and industry standards but no third-party regulatory oversight. Municipalities have their own governance procedures; they are self-governing with greater pricing transparency, consistent contractual delivery and contractual routes. The evidence suggests that these countries focus on consumer pricing and that introducing standardisation supports investment and stimulates the sector’s development.

Mandatory connection to heat networks is used in some of the comparator countries, establishing base heat loads and reducing demand uncertainty. Mandatory connections are primarily applied to new developments, but barriers exist to using them in the retrofit market. For example, in relation to timing of connection for retrofits: where buildings may have recently installed new carbon-based technologies, connection to a heat network may not be considered for many years until their heat source needs replaced. Finland decided to repeal mandatory requirement having concluded they could be deemed anti-competitive given other decarbonised heating options are also used successfully.

Clear government policies on decarbonisation and the phasing out of carbon-based fuels are evident among the comparator countries. Germany’s Building and Energy Act 2020 requires municipalities to have heating (including heat networks) powered by 65% renewable energy from January 2024 onward and to phase out existing oil and gas heating systems. The German Government is incentivising the transition via KfW and offering bonus support for an accelerated switch to heat networks or other renewable sources. Similarly, the Netherlands has banned new developments from connecting to the gas grid from 2028 via amendments to Gas Act 2018.

Market ownership profile and private finance penetration

Our comparator countries also tend to have different ownership structures, with ownership split between the public and private sector in different ways.

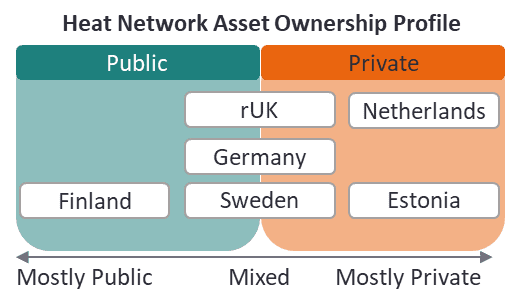

Figure 10 below shows the current profile of heat network ownership across each country, with Finland’s ownership largely public, the Netherlands and Estonia mostly private, and rUK, Germany and Sweden demonstrating mixed ownership structures.

Figure 10: Asset ownership profile

Key findings

Ownership profiles differ across the selected comparator countries with several observable themes. For some comparator countries, there is a high proportion of private sector finance. For example, in the Netherlands more than 90% of heat networks are managed by the private sector. This has helped to scale up investment. Established heat networks offer attractive, stable investments to institutional investors looking for long term consistent returns – as evidenced by Dutch pension institution PGGM investing in Swedish networks.

In other countries, including Finland, public sector ownership in the sector is at a high level. However, they are still seeking investment from the private sector to support established municipally owned heat networks, where budget restrictions limit upgrades and refurbishments. This ownership profile provides an interesting reference point for Scotland, as it allows the sector to benefit from additional investment.

The analysis shows significant levels of public ownership in many of the mature and maturing countries. In Germany, for example, Berlin’s municipality acquired the Berlin heat network for €1.4bn from Vattenfall. This demonstrated a commitment to re-municipalising infrastructure and reversing privatisations to gain more influence over the city’s district heating and gas supply. The municipality believes the Berlin network to be profitable and that it will play a significant role in moving toward climate neutrality.

In the Netherlands, the high levels of private sector ownership have resulted in the Dutch government proposing legislation in 2022 to part-nationalise the sector. Municipalities will have the opportunity to own up to 51% of networks, thereby bringing market ownership into the public sector. The proposal is designed to mitigate concerns regarding the affordability of heat for end users, the reliability of the services and the need to safeguard public sector climate change ambitions and public values. However, this initiative has led to significant concerns from several operators who feel that it will lead to a significant downturn in private sector investment[20]. During our stakeholder interviews, one European operator warned that this move will make the Netherlands “uninvestable”.

Overall, more mature markets tend to have a greater level of private finance penetration due to reduced risks and more stable operations. However, public sector ownership still allows local government to maintain more control regarding price and climate targets. Operators in the Netherlands indicated that the introduction of legislation to restrict private sector investment (and therefore control over the heat networks) can have a significant negative impact on the market and reduce investment security in the private sector. Under the new Dutch model, the incentives for private companies to invest in public projects are small and short term, as the private sector will lose control of the decision making while retaining significant levels of financial risk. Scotland should consider the impact that future regulatory changes may have on private sector investment appetite while balancing this with its broader objectives of reducing fuel poverty and supporting clean heat networks.

Financial composition of heat networks

The upfront capital expenditure expected revenue receipts and cash flow for other asset classes can be estimated with enough certainty to attract debt financing. In contrast, heat networks under development tend to have multiple expansion options and uncertainty around which end users will connect and when. This means costs or revenue inflows are not certain enough to allow a traditional project finance approach.

Rabobank, a Dutch multinational bank, highlighted that district heating companies self-financing their heating grids is a common approach in developing markets like the Netherlands. Their balance sheets typically include a mixture of debt and equity. Additionally, they also identify that traditional project financing is much harder to implement as it requires a significant portion of a project’s cashflows to be secured (by having contracted demand), which is an inherent problem for heat networks.

Rabobank also stated that whilst large credit worthy companies may be able to raise finance to fund heat networks and reduce their equity component of a project, smaller less bankable heat network developments may require government guarantees over any debt to help improve their attractiveness to private sector.[21]

The stakeholder engagement sessions also reflected the view that corporate balance sheet financing will remain the main source of financing in developing markets in the near-term.

Mature markets like Sweden, Finland and Estonia, benefit from more traditional forms of debt financing because they are well established and understood by lenders. For example, the NIB provided a €12m loan repayable over 10 years to help finance the heat network in Pirkanmaa, Finland.[22] These mature markets can also access EU financing to reduce dependence on carbon-based fuels. For example, the Finnish energy company Helen Ltd received a €150m loan in April 2024 via REPowerEU[23] for building a new heat pump plant and converting fuel use from coal to biomass pellets.

Consequently, developing heat networks are often funded purely from equity financing until they reach operational profitability. Only once stable profits are achieved can network operators consider refinancing and attracting debt lenders to expand their networks. Private Equity firms often take an equity stake in a heat network, but the composition of their fund could be a mixture of institutional debt and equity.

Conclusions

Our comparator countries present a mix of maturity levels, various ownership profiles, regulatory structures and financing levers. Those with more developed sectors have a mixed degree of public ownership and the ability to access private finance. They are mainly regulated by standard frameworks within the municipalities with regulators adopting a back seat approach. However, these countries with less regulation have had the technology embedded in their culture for much longer. Therefore, the regulators can focus on price transparency and fairness for the end user rather than a framework for developing the market.

Scotland has the opportunity to overcome the barriers faced by the sector by adopting solutions that have been successful elsewhere, including regulation, clear direction on decarbonisation and financing levers:

- Regulation: Standardised and practical regulatory frameworks help to ensure consistency across the market. They make it simpler for operators to undertake projects by reducing project complexity. Additionally, standardised frameworks and agreements provide greater certainty and transparency regarding control and responsibility of heat network assets. This provides operators with confidence over the assets.

- Decarbonisation: All of the countries on our shortlist are actively moving away from fossil fuel heat networks and incentivising clean heat networks through policy choices. For example, sector development may be encouraged through connection subsidy or a phased ban on carbon-based alternatives. Additionally, mandatory connections provide a baseline for investment cases, making projects investible as demand assurance can be satisfied. Equally, contracted revenues obtained as part of the demand assurance may provide enough certainty to encourage private investment into heat networks.

- Financing levers: Comparator countries have provided financial incentives for connecting to existing heat networks offering further incentives for accelerated uptake. Capital grant support is the most common lever used by international comparators across all market maturities as it can make the investment decision for expansion of heat networks more viable. Similarly, when networks are seeking connections, individuals need to be incentivised to connect. For example, by bridging the gap on cost to their current heat sources, particularly when there are no regulations requiring individuals to connect. Additionally, state-owned infrastructure banks can be used to leverage these solutions as the market develops. For example, if connection fees are mandatory, a connection fee facility could be rolled up into the overall financing solution as there will be enough clarity on contracted revenue cashflows to reduce demand assurance risk.

The key considerations can be summarised as follows:

- simple and standardised frameworks to ensure consistency within the regulations

- clear direction on decarbonisation

- the use of mandatory connections (such as on new developments) to provide certainty

- public financing levers to develop projects and also to incentivise individuals to connect.

Review of financing mechanisms in selected utility sectors

Introduction

The UK utilities sector is a multifaceted industry that provides essential services for the protection and maintenance of modern daily life and commerce. These services include the provision of electricity, gas, water, telecommunications and transport. Each segment and subsector of the utility sector is integral to the economy’s stability, growth and societal well-being. Regulation of such sectors ensures that individuals, and businesses have access to the critical resources they require at a reasonable cost.

Each UK utility sector is governed by a specific regulator responsible for consumer protection (including pricing), safety, reliability and sustainability, ensuring a well-developed network of public services provided under regulatory regimes, as outlined in Appendix C. The primary regulators include:

- The Office of Gas and Electricity Markets (Ofgem)

- The Water Services Regulation Authority (Ofwat) in England and Wales

- The Office of Communications (Ofcom)

- The Office of Rail and Road (ORR)

- The Civil Aviation Authority (CAA)

The global shift towards net zero, with an emphasis on clean heating systems, requires the development of regulatory regimes to incorporate new energy solutions.

Regulatory oversight will remain crucial for balancing the objectives of climate change mitigation with continued access to reliable and affordable utility services. As a result, heat networks are planned to be subject to formal regulation across England, Wales and Scotland by 2024/25 in line with primary legislation introduced as part of the Energy Act 2023 and the Heat Networks (Scotland) Act 2021.

Purpose

This section of the report examines the origins and current characteristics of other regulated utility sectors. We also explore if specific aspects of the regulation of other sectors can inform the regulatory and financial environment, which will help accelerate the development of heat networks in Scotland.

To aid in understanding how potential heat networks regimes may develop, we outline how the sectors have historically been financed and how the regulatory structures have facilitated the deployment of capital.

Methodology

We performed analysis to identify regulated utilities which offer a good comparator to heat networks. This included examining the characteristics of a long list of 39 regulated sectors covering electricity, water, telecommunications, rail and air regulation against the criteria listed in Appendix D. Based upon the preliminary analysis, we progressed 17 utilities for further examination which is discussed in Appendix K.

Further to the completion of the detailed analysis (Appendix K), we determined that offshore wind electricity generation, household water & sewerage undertakers and Carbon Capture, Utilisation and Storage (CCUS) demonstrated relevant attributes for heat networks. The key characteristics of each sector are summarised in Appendix E. This includes risk profile, type of sector the utility operates within and the investment time horizon for each utility.

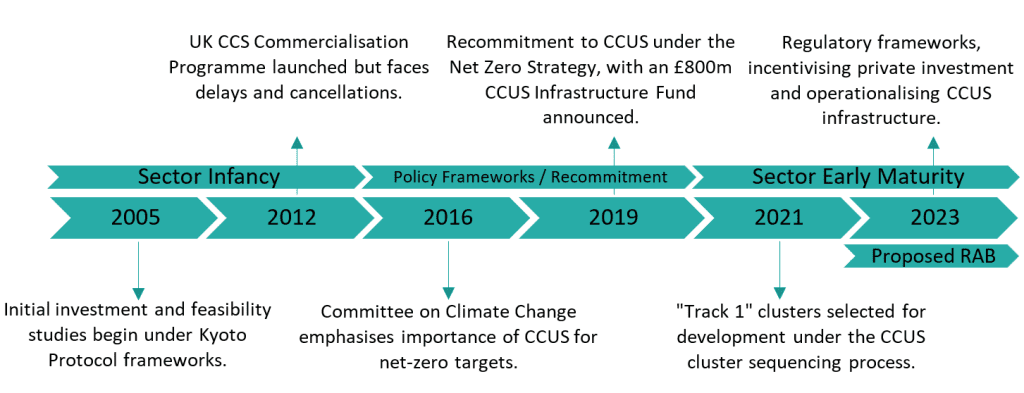

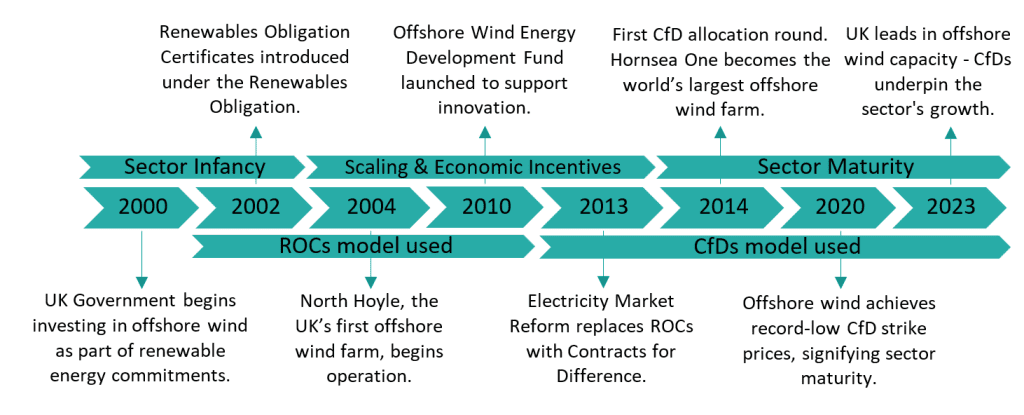

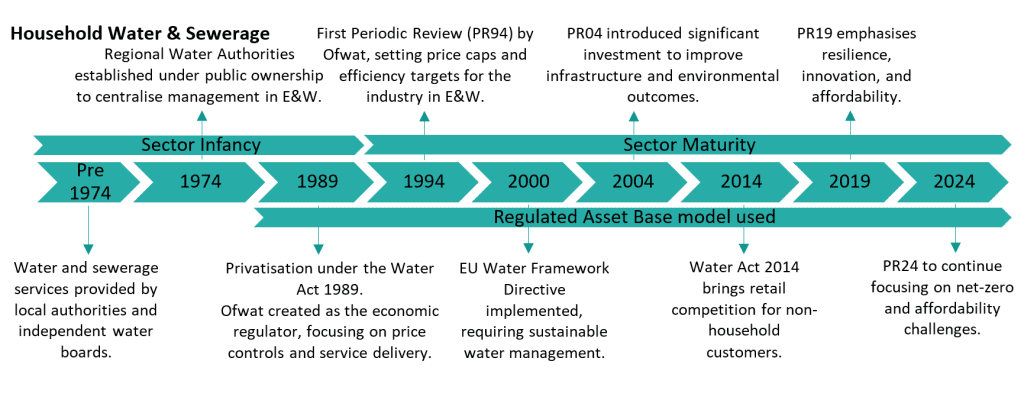

These three utilities are used to understand how the utility sector is regulated and how investment supports ongoing development. They are also used to explore how heat networks might be regulated and how regulatory approaches impact levels of financing. Each sector is analysed separately below before evaluating how aspects could be applied to heat networks. A summary of regulatory timelines for these sectors is shown in Appendix F.

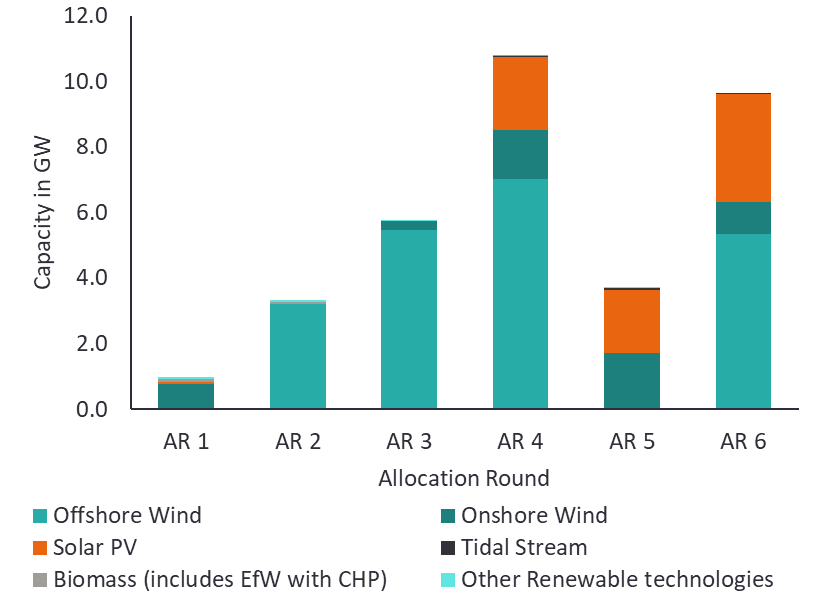

Offshore wind

Overview

The UK’s offshore wind sector is rapidly expanding and plays a pivotal role in the nation’s transition to renewable energy. Between the UK’s first offshore wind allocation round (AR1 2015) and AR 6 (2024), a total of 21 GW of offshore wind capacity has been supported by Contracts for Difference (CfDs). CfDs are explained in more detail below.

Regulatory Structure

Following the Energy Act 2004, Ofgem has continued to regulate the sector and is adapting its approach as offshore wind projects continue to be deployed, offering new support mechanisms. Ofgem’s regulation of offshore wind is structured around several key elements. It is designed to promote the development of the sector whilst ensuring efficiency, competition and the protection of consumers interests. Regulations cover, licensing, support mechanisms, grid connection, market oversight and consumer protection. Further details can be found at Appendix G.

Ofgem’s remit also extends to the provision of Innovation Funding to support the transition to net-zero energy systems. This includes support to accelerate technological advancements, improve efficiency and reduce costs.

Regulatory Financing Mechanisms

Offshore wind is characterised by large upfront capital expenditure, availability risk (wind variability) and exposure to a competitive and volatile electricity market. All these factors impact the sector’s ability to secure much needed investment. The investment time horizon is around 15 years commensurate with the term of a CfD. Unlike the deployment of heat networks, offshore wind is not exposed to demand risk as it operates on a wholesale basis whereby electricity is exported directly to the national grid.

CfDs provide long-term stable and predictable revenue for offshore wind developers, thus making offshore wind attractive to investors, creating optimised financing structures that can reduce the overall cost of capital. A CfD has the effect of providing a fixed price for each MWh of electricity that the project generates over a specified period (typically 15 years) referred to as the “Strike Price”. The Strike Price typically reflects the price per MWh a developer considers necessary to achieve its applicable return on investment over the period of the CfD. CfDs are awarded through a competitive auction process (Allocation Round) administered by the Department of Energy Security and Net Zero (DESNZ).

The Strike Price is different to the actual market price, known as the “Reference Price”, which is calculated based on the average market price per MWh over a given period. When the Reference Price is lower than the Strike Price, a top up payment of the difference in price is made by the Low Carbon Contracts Company (LCCC) to the offshore generator. Conversely, if the Reference Price is greater than the Strike Price, then the generator must pay the difference to LCCC.

CfDs were originally introduced in 2013 and replaced the Renewable Obligation Certificate (ROC) regime, which was the main support mechanism for renewable energy prior to CfDs. CfDs are an evolution of the support mechanism for renewable energy projects that increases competition and whereby the Strike Price better reflects the underlying levelised cost of the technology.

Household water & sewerage undertakers

Overview

The household water and sewerage sector in the UK provides essential water supply and wastewater services to residential and commercial customers. The sector operates as a natural monopoly and is therefore highly regulated across England and Wales and Scotland.

Regulatory Structure

England and Wales

In England and Wales the sector is regulated by Ofwat. The regulator aims to ensure high-quality services, fair pricing, compliance with environmental standards, and the financial viability of water companies. The regulatory structure has evolved over time to address priorities such as infrastructure investment, customer service improvement and environmental concerns.

Key changes include the introduction of competition to drive efficiency, periodic price reviews by setting price limits and service targets, increased customer engagement, and innovation funding. These changes aim to create a more outcome-based regulatory regime that encourages water companies to be customer-oriented, efficient, and forward-thinking in their operations and investments, ensuring high standards of water quality and environmental stewardship.

Scotland

Scottish Water is regulated by the Water Industry Commission for Scotland (WICS), which ensures value for money and efficiency without a profit motive. This aligns with Scottish Government policies on affordability and public ownership. WICS is governed by the Water Industry (Scotland) Act 2002, as amended by the Water Services etc. (Scotland) Act 2005 and the Water Resources (Scotland) Act 2013.

WICS’ role is to set charge caps, monitor performance, facilitate retail competition for non-household customers, and support the Hydro Nation vision. Price reviews are conducted every six years. Reviews set price limits based on Scottish Water’s business plan, customer input, and factors such as debt service and operational efficiency, with a transition away from the RAB model since 2010.

WICS also sets efficiency targets and, while independent, can be influenced by Scottish Ministers on financial matters, potentially impacting long-term infrastructure maintenance if charges are set too low. Scottish Water receives government loans or grants for large capital projects, reducing reliance on customer charges. However, this funding depends on the impact on the Scottish Government’s balance sheet, requiring careful management for long-term sustainability. Further details on this can be found at Appendix H.

Regulatory Financing Mechanisms

England and Wales

The water and sewerage sector relies on long-term investment provided by the capital markets, typically in the form of shareholder equity and bond finance. Most utilities are highly geared and therefore very sensitive to adverse changes in credit ratings (via Moody’s, S&P and Fitch). Nearly all utilities aim for an investment-grade credit rating to secure optimum lending terms with the primary objective of lowering the company’s Weighted Average Cost of Capital (WACC).

Ofwat’s regulation and associated pricing reviews provide a stable financial environment for investors. They ensure reliable demand due to the monopolistic nature of the customer base despite some revenue risk from bad debt. The application of a Regulated Asset Base (RAB) model (discussed below) along with the submission of Asset Management Plans (AMPs) that contribute to periodic price reviews, is designed to incentivise investment in infrastructure and services whereby the water companies are required to manage risks related to capital programmes, asset maintenance and operational costs similar to those in the heat network sector.

Regulated Asset Based (RAB)

The RAB model regulates water company prices while ensuring infrastructure maintenance and service quality. The RAB represents the value of a company’s capital assets based on historical costs, depreciation, and new investments. Ofwat uses the RAB value to set allowed revenue requirements, applying a WACC to determine the maximum revenue companies can charge, incentivising efficient investment and continual infrastructure improvements. This model is effective in the water sector due to the manageable number of operators, encouraging companies to invest efficiently and include new investments in future revenue streams.

Periodic Price Reviews

Ofwat’s price reviews, conducted every five years, determine the revenue water companies can earn. They take into both capital and operational expenditures into consideration to set price controls and encourage large-scale investment projects. The submission of AMPs contributes to the periodic price review process, which includes performance incentives through Outcome Delivery Incentives (ODIs), rewarding companies for meeting targets and penalising underperformance, aligning financial interests with high-quality service delivery. The periodic pricing reviews, coupled with limited demand risk provides greater revenue certainty for investment.

The latest Asset Management Plan (AMP8) for 2025-2030 focuses on climate change, emissions reduction, water quality improvement, leakage reduction, and reliable services. It also introduces innovative funding solutions such as the Direct Procurement for Customers (DPC) programme to support significant infrastructure investments.

Innovation funding

Although there are many external innovation funds available to water companies, Ofwat has established its own Ofwat Innovation Fund. The aim of this £200m fund is to encourage collaborative initiatives and partnerships within the water sector to tackle the larger challenges the sector faces such as climate change, leakage and affordability.

Scotland

Whilst Ofwat regulates the water sector in England and Wales, privatisation of the sector has resulted in high debt leverage which can give rise to value leakage to shareholders and risk of under investment of infrastructure. Thames Water, England’s largest water company, has requested that Ofwat approves an increase in water bills of up to 40% by 2030.

Scotland has sought to mitigate these specific risks through the water services being publicly owned. Services are operated by Scottish Water which remains accountable to the Scottish Government and its customers. This helps to ensure profits are reinvested in the infrastructure rather than distributed to shareholders. WICS is an Executive Non-Departmental Public Body whose principle statutory functions are to:

- Determine charge caps;

- Monitor Scottish Water’s performance, encouraging efficiency and sustainability;

- Facilitate competition by encouraging the entry of retail water and sewerage providers for non-household customers in Scotland; and